The Recent Surge In Heating Oil Prices: A Precursor To Looming Inflationary Pressures

As heating oil prices continues to rise, propelled by diminishing crude oil stockpiles, a shift in refining priorities toward gasoline, and severe weather events, the real focus is its ability to forecast future inflation metrics.

Heating oil, a vital commodity for powering boilers, furnaces, and water heaters, predominantly serves the Northeast region. Essentially a crude oil distillate like diesel fuel, its market behavior consists of seasonal fluctuations affecting supply, demand, and subsequently, pricing.

In recent months the market has seen oil producers trim rig counts, adjusting oil supply to meet current market demand, all while safeguarding their cash flows. The increase in demand for gasoline has influenced refiners to focus on increasing gasoline output while neglecting products like heating oil, jet fuel, and diesel, resulting in higher prices.

The Inflation Factor

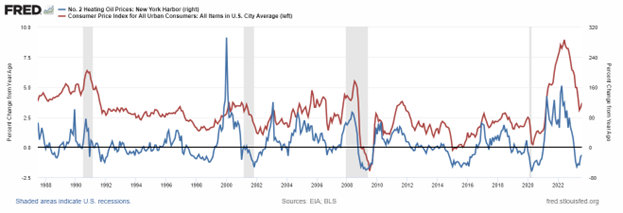

Although heating oil is not a very popular traded product among the retail community, it does provide a lot of value in determining the direction of headline inflation. Below, this chart compares the year-over-year percentage change of heating oil prices in blue, and the year-over-year headline inflation in red.

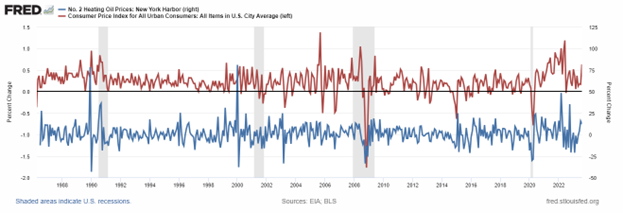

As you can see from the chart, heating oil price changes have a very close relationship with the CPI. In fact, in most cases, it leads inflation. We can see the same trend when comparing the month-over-month percentage change in heating oil prices to the month-over-month percentage change in headline inflation.

As we approach November and December, the year-over-year base effect is anticipated to diminish, setting the stage for inherent inflation in the upcoming months — a scenario the Federal Reserve aims to sidestep.

The escalating geopolitical tension in Europe threatens to intensify volatility across all energy markets even further, ushering in conditions ripe for reinflation that the market seems to be discounting at the moment.

In this fluctuating landscape, heating oil prices demand close monitoring as a potential signal of pending inflation, making it a focal point for investors and policymakers. Just something to keep an eye on.

This article was submitted by an external contributor and may not represent the views and opinions of Benzinga.

Posted-In: contributors CPI Expert Ideas Heating Oil InflationEconomics Federal Reserve Markets