EUR/USD Shows Resilience Amid Risk Appetite

By RoboForex Analytical Department

The EUR/USD pair is trading close to 1.0821, demonstrating a strong stance in the current market environment. Investors are leaning towards riskier assets, buoyed by the anticipation of several key macroeconomic releases this week.

A critical focal point for the market will be the upcoming US inflation data, particularly the core Personal Consumption Expenditures (PCE) price index, a preferred measure of inflation by the Federal Reserve. The report, expected to be released on Thursday, is forecasted to show a 0.4% month-on-month increase. This data is crucial as it influences the Fed's monetary policy decisions.

The prevailing market sentiment suggests that the Federal Reserve may not be poised to embark on a monetary easing cycle just yet, opting instead to maintain the current interest rate levels for a longer duration.

Technical Analysis For EUR/USD

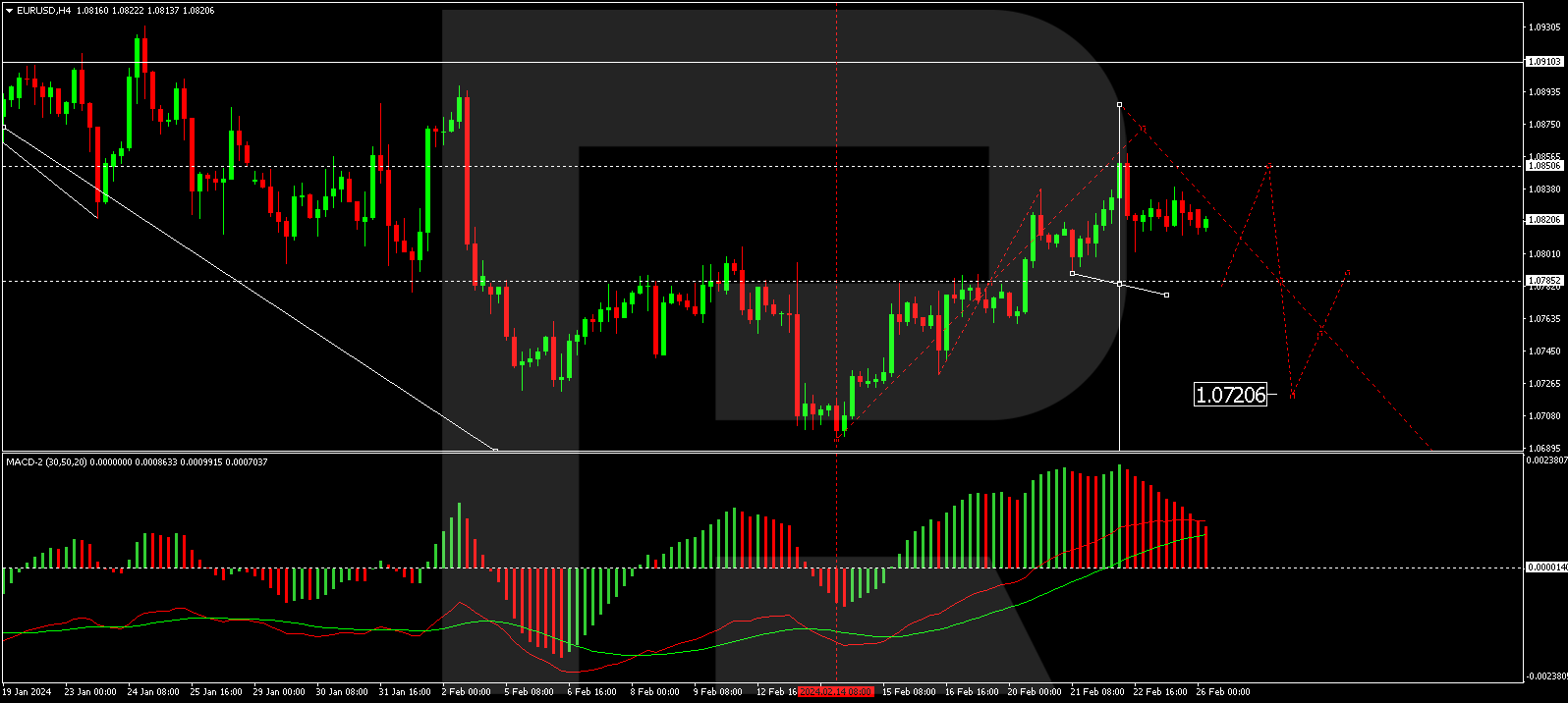

On the H4 chart, EUR/USD has shown a downtrend, reaching a low of 1.0802. It's anticipated that a corrective movement could occur next. After this correction, the price is expected to decline to 1.0785, where it might form a consolidation range. A break below this range could lead to a further decrease towards the local target of 1.0720. This bearish scenario is supported by the MACD indicator, with its signal line positioned below zero and the histogram indicating a sharp decline, suggesting a potential further decline in the price to new lows.

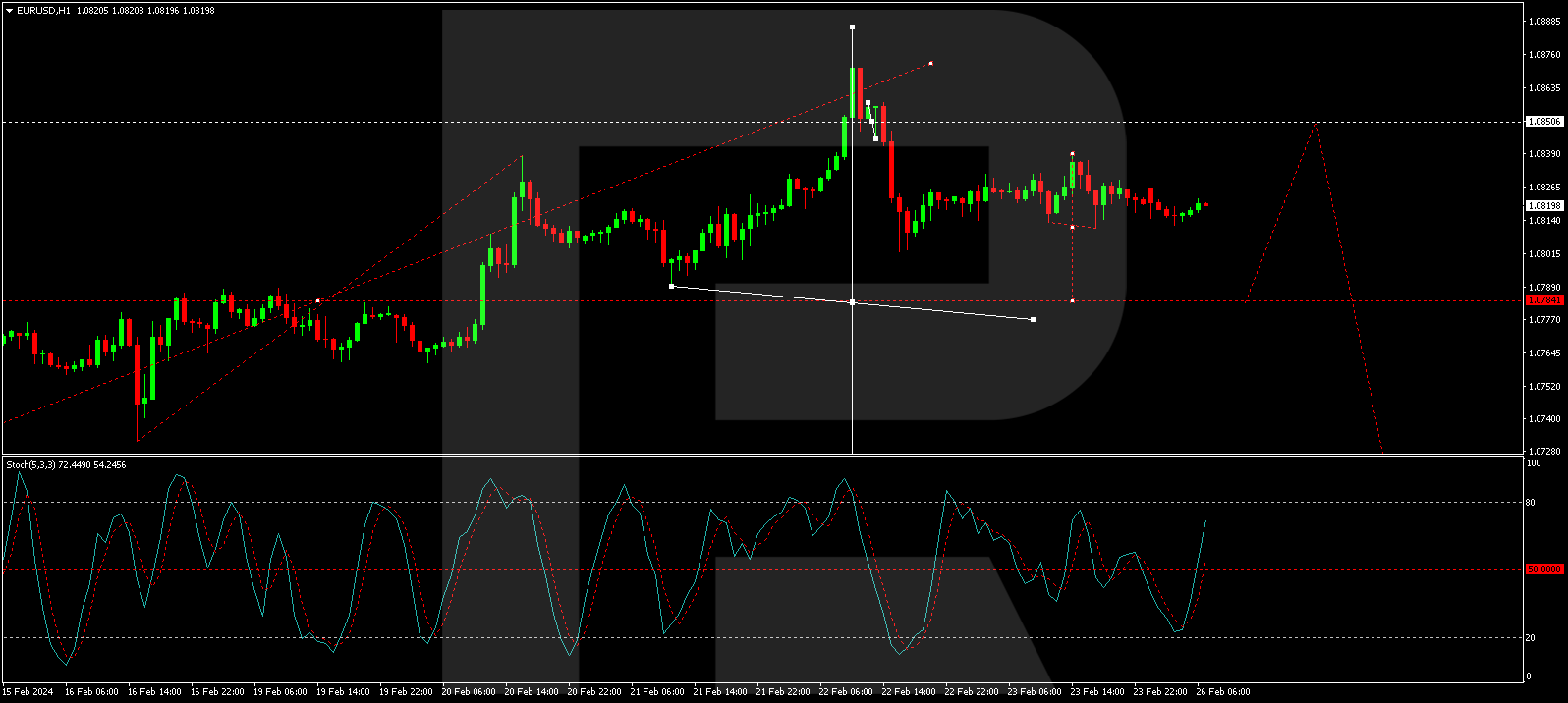

The H1 chart presents a consolidation phase around 1.0824, followed by a potential drop to 1.0784. After reaching this level, the price may rebound to 1.0850 before descending again to 1.0720. This analysis is corroborated by the Stochastic oscillator, with its signal line currently near 80 and anticipated to drop to 20, indicating the likelihood of further price movements within this trend.

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

This article was submitted by an external contributor and may not represent the views and opinions of Benzinga.

Posted-In: contributors EUR/USD Expert Ideas InflationTechnicals Markets Trading Ideas General