Top 3 Consumer Stocks That May Explode In December

The most oversold stocks in the consumer discretionary sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Sturm Ruger & Company Inc (NYSE:RGR)

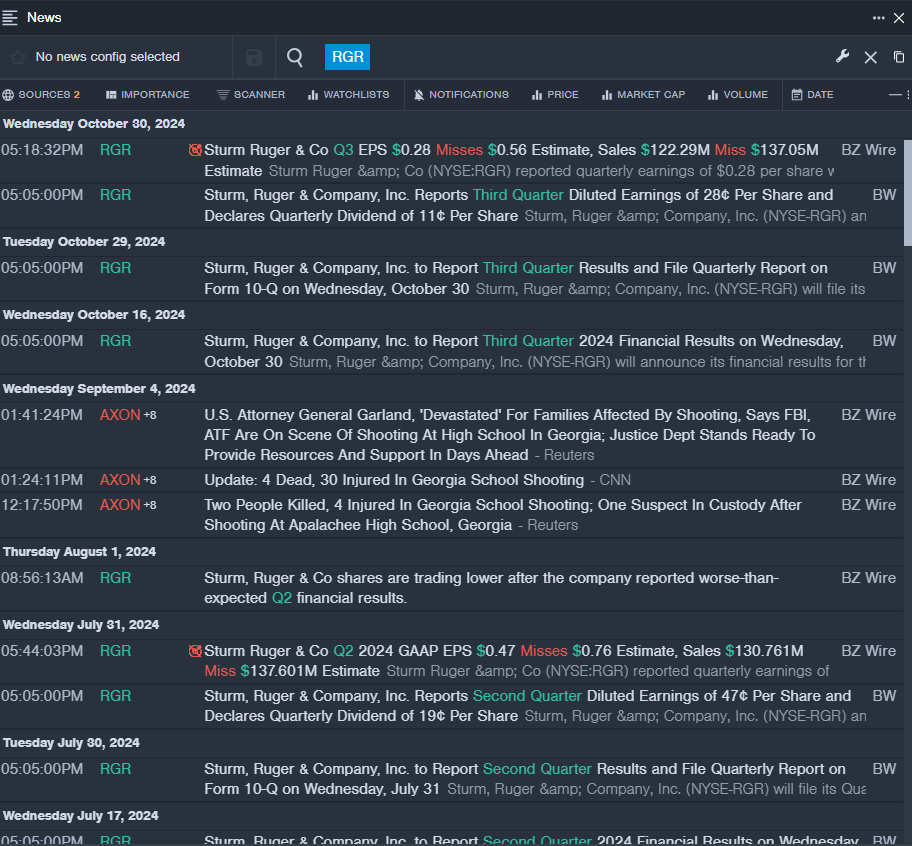

- On Oct. 30, Sturm Ruger & Co posted weaker-than-expected quarterly earnings. Chief Executive Officer Christopher J. Killoy said, “The diversity of our products has been instrumental to our performance this year. We capitalized on the strong demand for several of our product families, including the Ruger American Rifle Generation II bolt-action rifles, the Marlin lever-action rifles, and the Security-380 pistol, maintaining our market share without sacrificing our long-term focus or pricing discipline. Despite the current promotion-rich environment, the estimated sell-through of our products from our independent distributors to retailers increased while our finished goods inventory and our distributors’ inventories have decreased 125,000 units in the past year." The company's stock fell around 9% over the past month and has a 52-week low of $34.29.

- RSI Value: 29

- RGR Price Action: Shares of Sturm Ruger fell 1% to close at $34.65 on Friday.

- Benzinga Pro's real-time newsfeed alerted to latest RGR news.

Guess? Inc (NYSE:GES)

- On Nov. 26, Guess? reported a year-over-year decrease in third-quarter adjusted EPS results. Paul Marciano, Co-Founder and Chief Creative Officer, commented, “This year we have made significant investments for Guess in new product introductions and increased marketing campaigns, and the customers have responded well." The company's stock fell around 21% over the past month and has a 52-week low of $13.54.

- RSI Value: 27

- GES Price Action: Shares of Guess fell 1.7% to close at $13.66 on Friday.

- Benzinga Pro’s charting tool helped identify the trend in GES stock.

Full House Resorts Inc (NASDAQ:FLL)

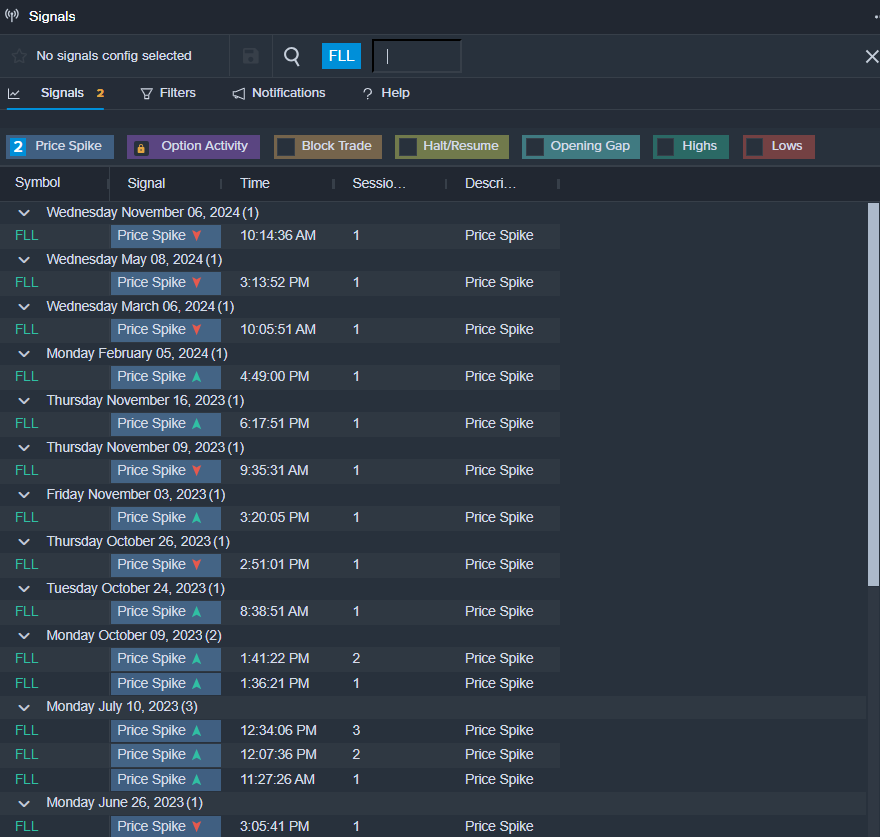

- On Nov. 6, Full House Resorts posted weaker-than-expected quarterly results. “American Place continued its meaningful growth during the third quarter of 2024,” said Daniel R. Lee, President and Chief Executive Officer of Full House Resorts. “This still relatively-new property, which opened in February 2023, grew revenues and Adjusted Property EBITDA by 17.7% and 13.6%, respectively. We look forward to further growth at American Place in 2025 and beyond. The company's stock fell around 15% over the past month and has a 52-week low of $3.77.

- RSI Value: 27

- FLL Price Action: Shares of Full House Resorts slipped 0.5% to close at $3.93 on Friday.

- Benzinga Pro’s signals feature notified of a potential breakout in FLL shares.

Read This Next:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: consumer OVERSOLD Oversold StocksLong Ideas News Pre-Market Outlook Markets Trading Ideas