Wall Street's Most Accurate Analysts Weigh In On 3 Consumer Stocks With Over 5% Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the consumer discretionary sector.

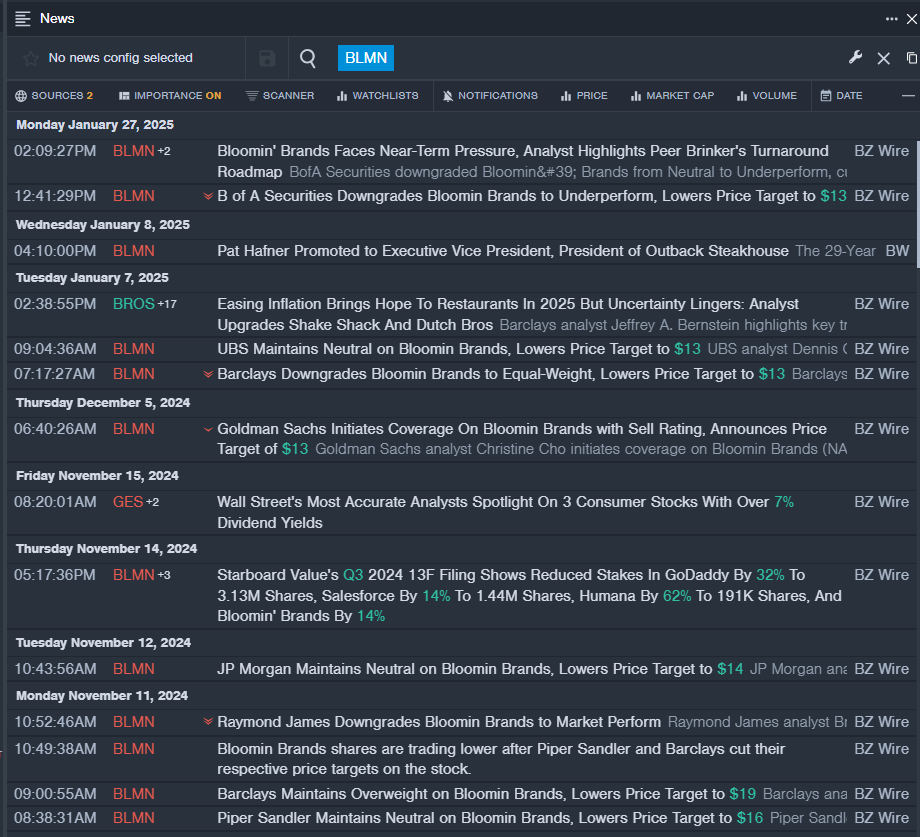

Bloomin’ Brands, Inc. (NASDAQ:BLMN)

- Dividend Yield: 7.71%

- B of A Securities analyst Justin Post downgraded the stock from Neutral to Underperform and cut the price target from $18 to $13 on Jan. 27, 2025. This analyst has an accuracy rate of 85%.

- UBS analyst Dennis Geiger maintained a Neutral rating and slashed the price target from $16 to $13 on Jan. 7, 2025. This analyst has an accuracy rate of 67%.

- Recent News: On Jan. 8, Bloomin’ Brands announced the promotion of Pat Hafner to Executive Vice President, President of Outback Steakhouse.

- Benzinga Pro's real-time newsfeed alerted to latest BLMN news.

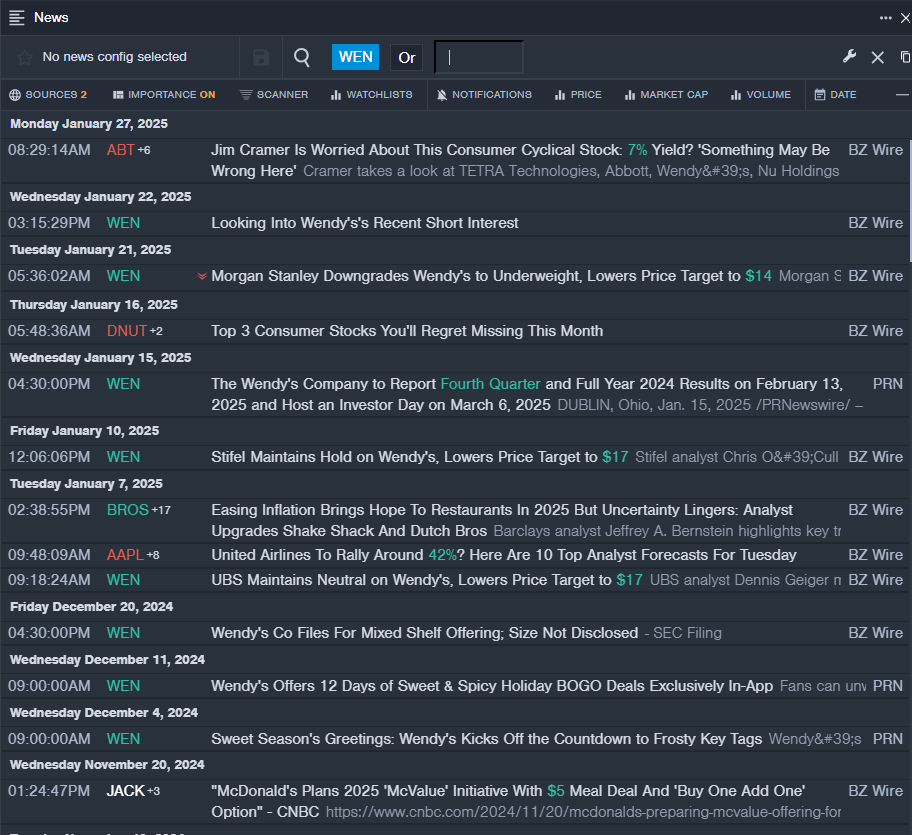

The Wendy’s Company (NASDAQ:WEN)

- Dividend Yield: 6.84%

- Morgan Stanley analyst John Glass downgraded the stock from Equal-Weight to Underweight and cut the price target from $22 to $14 on Jan. 21, 2025. This analyst has an accuracy rate of 61%.

- Stifel analyst Chris O'Cull maintained a Hold rating and cut the price target from $18 to $37 on Jan. 10, 2025. This analyst has an accuracy rate of 79%.

- Recent News: The Wendy’s Company will report fourth quarter and full year 2024 results on Feb. 13, 2025.

- Benzinga Pro's real-time newsfeed alerted to latest WEN news.

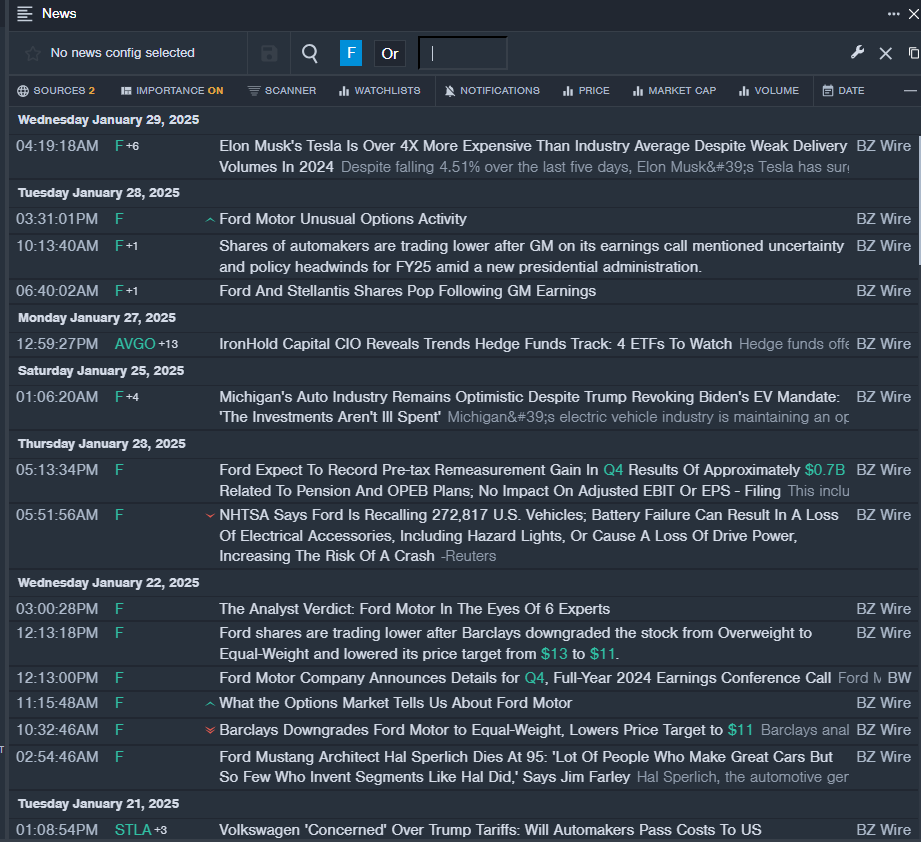

Ford Motor Company (NYSE:F)

- Dividend Yield: 5.95%

- Jefferies analyst Philippe Houchois downgraded the stock from Hold to Underperform and cut the price target from $12 to $9 on Dec. 16, 2024. This analyst has an accuracy rate of 74%.

- Wolfe Research analyst Emmanuel Rosner downgraded the stock from Peer Perform to Underperform on Dec. 5, 2024. This analyst has an accuracy rate of 74%.

- Recent News: Ford said it expects to record pre-tax remeasurement gain in Q4 results of approximately $0.7 billion related to pension and OPEB plans.

- Benzinga Pro’s real-time newsfeed alerted to latest F news.

Read More:

Posted-In: consumerNews Dividends Price Target Pre-Market Outlook Markets Analyst Ratings Trading Ideas