Amazon Attracts $119 Million Investment From Activist Hedge Fund ValueAct: Analysts See 25% Upside — What Catalysts Drive Jeff Bezos' E-Commerce Giant?

ValueAct Holdings, L.P. has initiated a significant position in Amazon.com Inc. (NASDAQ:AMZN), purchasing 536,900 shares worth approximately $119 million during the fourth quarter of 2024, according to a13F filing with the Securities and Exchange Commission on Feb. 14.

What Happened: The investment comes as Amazon continues to demonstrate strong market performance and strategic expansion. The e-commerce giant reported fourth-quarter net sales of $187.8 billion, representing a 10% year-over-year increase and exceeding analyst expectations of $187.3 billion.

The company’s AWS cloud division showed particularly robust growth, with revenues climbing 19% to $28.8 billion.

JPMorgan analyst Doug Anmuth recently named Amazon his “Best Idea” for 2025, projecting continued e-commerce acceleration. Despite a slight market share dip to 46.1% in the fourth quarter, Amazon maintains its dominant position in U.S. e-commerce, having delivered over 9 billion items within a single day in 2024.

Why It Matters: The company is also making strategic moves in entertainment, with Amazon MGM Studios recently gaining creative control over the James Bond franchise through a new joint venture with longtime producers Michael G. Wilson and Barbara Broccoli. This development prompted Amazon founder Jeff Bezos to engage with fans about potential casting choices for the next 007.

ValueAct’s investment aligns with the firm’s history of backing technology and growth sectors. Founded by Jeff Ubben in 2000, the San Francisco-based activist hedge fund has evolved beyond its founder’s influence since his departure, as noted in a 2020 Financial Times interview.

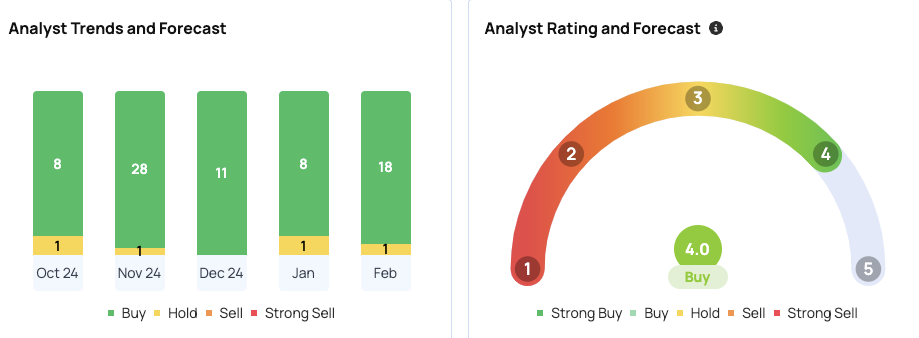

Wall Street maintains a bullish outlook on Amazon, with a consensus price target of $264.05 based on 43 analyst ratings. Recent price targets from Loop Capital, Citigroup, and Maxim Group average $279.33, indicating a potential 25.12% upside from the current price of $222.88.

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: 13F Jeff Bezos KeyProj L.P. ValueActEquities News Markets