Peter Schiff Expects Mining Firm Newmont Corp To Top $100 Amid Gold Price Rally: 'Wall Street Is Worthless'

Economist Peter Schiff criticized UBS’s recent upgrade of Newmont Corp. (NYSE:NEM), citing room for a higher price target and better outlook. Technical analysis of Newmont’s stock indicates a bullish uptrend in the near term.

What Happened: Schiff, the chief economist and global strategist at Europac.com, argued that UBS’s upgrade is too little, too late, and their price target for Newmont doesn’t adequately reflect the potential upside for a gold mining company in a strongly rising gold market.

He sees UBS’s analysis as flawed and indicative of Wall Street’s general misunderstanding or underestimation of the potential in precious metals, saying, “Wall Street is worthless.”

With the given macroeconomic scenario, Schiff says, “NEM should top $100.”

Why It Matters: Citing a favorable gold macro outlook and strong shareholder return potential, UBS upgraded Newmont to “buy” from “hold” with a $60 price target, according to an Investing.com report.

UBS’ upgrade of NEM follows a higher forecast for gold prices at $3,500/oz for fiscal 2026, expecting positive operational momentum for Newmont after underperforming. They anticipate a ~10% free cash flow yield in 2026.

Newmont’s planned $3 billion buyback in 2026, funded by divestments, and progress towards its net debt target further support the upgrade, despite past operational inconsistencies.

The stock’s technical analysis shows that NEM’s Friday closing price of $54.97 was higher than its short and long-term simple daily moving averages, indicating a bullish price trend. Its relative strength index at 73.09 was in the overbought zone, hinting at a possible decline in the near term.

However, its MACD momentum indicator was positive with the MACD line of 1.30, showcasing its 12-period exponential moving average to be above its 26-period EMA, suggesting positive momentum in the near term.

Price Action: The Newmont stock rose 7.91% on Friday, and it was up 0.38% in premarket on Monday. The stock 43.26% on a year-to-date basis.

The exchange-traded fund tracking the S&P 500 index, SPDR S&P 500 ETF Trust (NYSE:SPY), rose 1.78% on Friday and advanced by 1.23% in Monday’s premarket.

Gold Spot US Dollar declined 0.36% to hover around $3,224.62 per ounce. Its fresh record high stood at $3,245.76 per ounce.

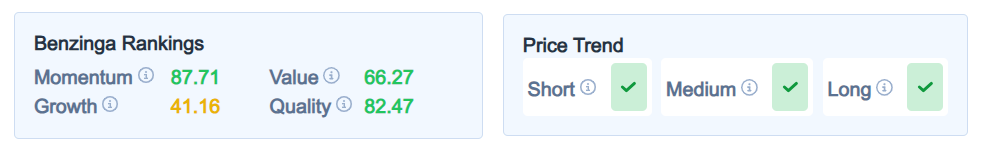

Benzinga Edge Stock Rankings indicate Newmont has a strong price trend over the short, medium, and long term. Its momentum ranking was solid at the 87.71th percentile, and its value ranking was also stronger. Further fundamental, growth, and quality rankings are available here.

Benzinga’s analysis of 23 analysts shows a consensus “hold” rating for the stock, with an average price target of $53.4, ranging from $38 to $67. Recent ratings from UBS, Raymond James, and RBC Capital average $58.33, suggesting a 5.71% potential downside.

Read Next:

Photo courtesy: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Gold Peter Schiff UBSEquities News Commodities Markets Analyst Ratings