Wall Street's Most Accurate Analysts Give Their Take On 3 Utilities Stocks Delivering High-Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the utilities sector.

Dominion Energy, Inc. (NYSE:D)

- Dividend Yield: 5.04%

- JP Morgan analyst Jeremy Tonet downgraded the stock from Neutral to Underweight and cut the price target from $59 to $52 on April 8, 2025. This analyst has an accuracy rate of 65%.

- Scotiabank analyst Andrew Weisel maintained a Sector Perform rating and raised the price target from $58 to $61 on Dec. 12, 2024. This analyst has an accuracy rate of 70%.

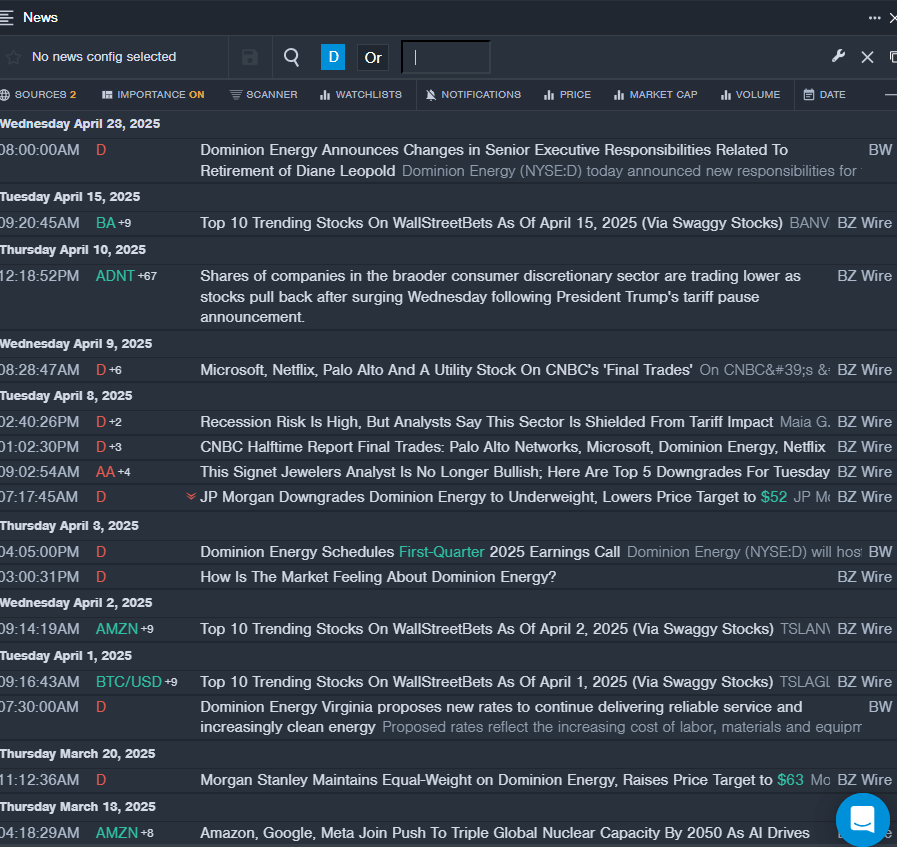

- Recent News: On April 23, Dominion Energy announced changes in senior executive responsibilities related to retirement of Diane Leopold.

- Benzinga Pro’s real-time newsfeed alerted to latest D news.

Portland General Electric Company (NYSE:POR)

- Dividend Yield: 5.08%

- Barclays analyst Nicholas Campanella maintained an Equal-Weight rating and raised the price target from $47 to $48 on April 22, 2025. This analyst has an accuracy rate of 65%.

- JP Morgan analyst Richard Sunderland downgraded the stock from Overweight to Neutral and cut the price from $50 to $44 on April 10, 2025. This analyst has an accuracy rate of 66%.

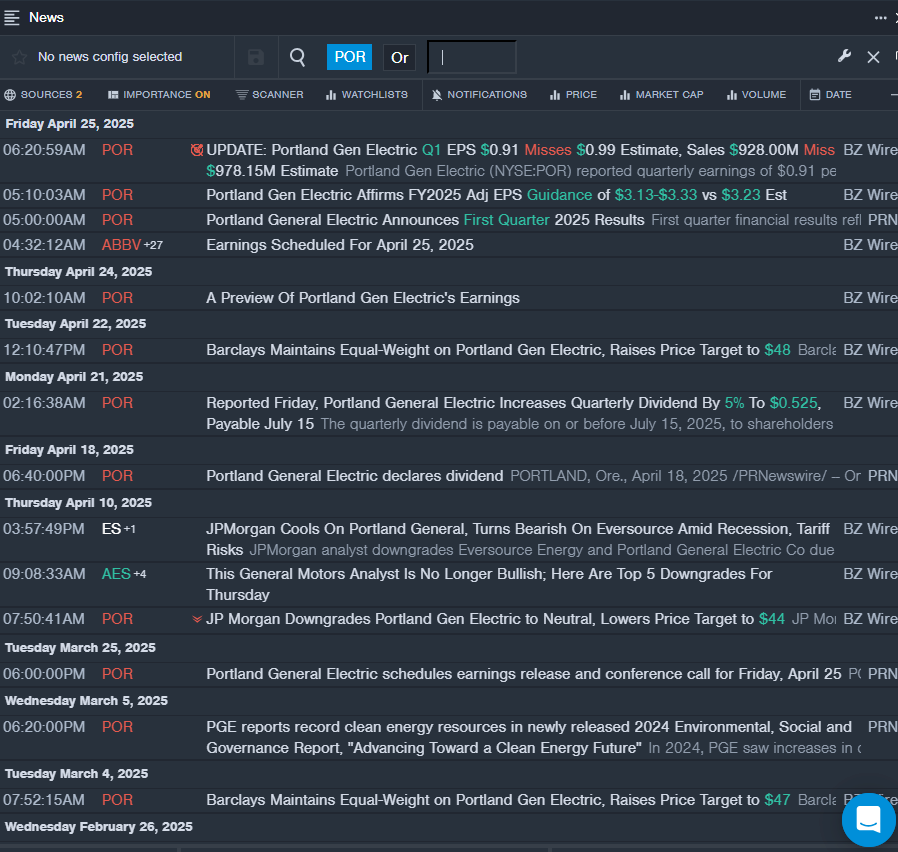

- Recent News: On April 25, Portland Gen Electric posted downbeat quarterly results.

- Benzinga Pro's real-time newsfeed alerted to latest POR news

Avista Corporation (NYSE:AVA)

- Dividend Yield: 4.77%

- Jefferies analyst Julien Dumoulin-Smith maintained a Hold rating and cut the price target from $40 to $39 on Jan. 28, 2025. This analyst has an accuracy rate of 69%.

- Mizuho analyst Anthony Crowdell upgraded the stock from Underperform to Neutral and raised the price target from $32 to $36 on May 3, 2024. This analyst has an accuracy rate of 65%.

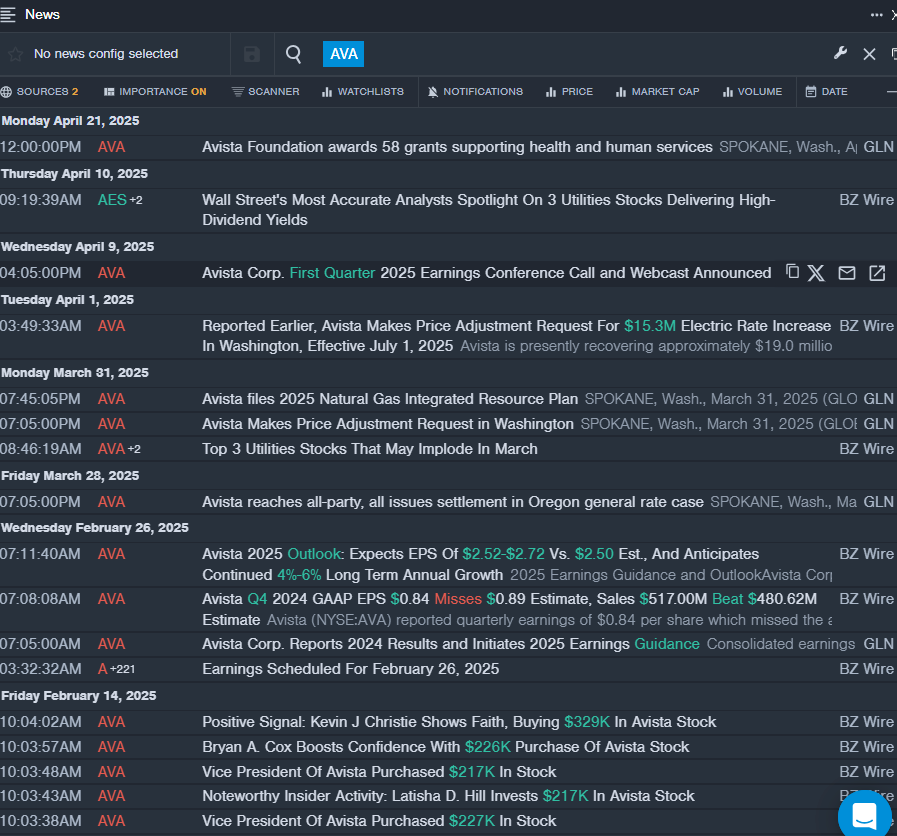

- Recent News: Avista will hold its quarterly conference call to discuss first quarter results on Wednesday, May 7.

- Benzinga Pro’s real-time newsfeed alerted to latest AVA news

Read More:

Photo via Shutterstock

Posted-In: dividend yield e xpert ideasNews Price Target Pre-Market Outlook Markets Analyst Ratings Trading Ideas