Wall Street's Most Accurate Analysts Weigh In On 3 Consumer Stocks Delivering High-Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the consumer discretionary sector.

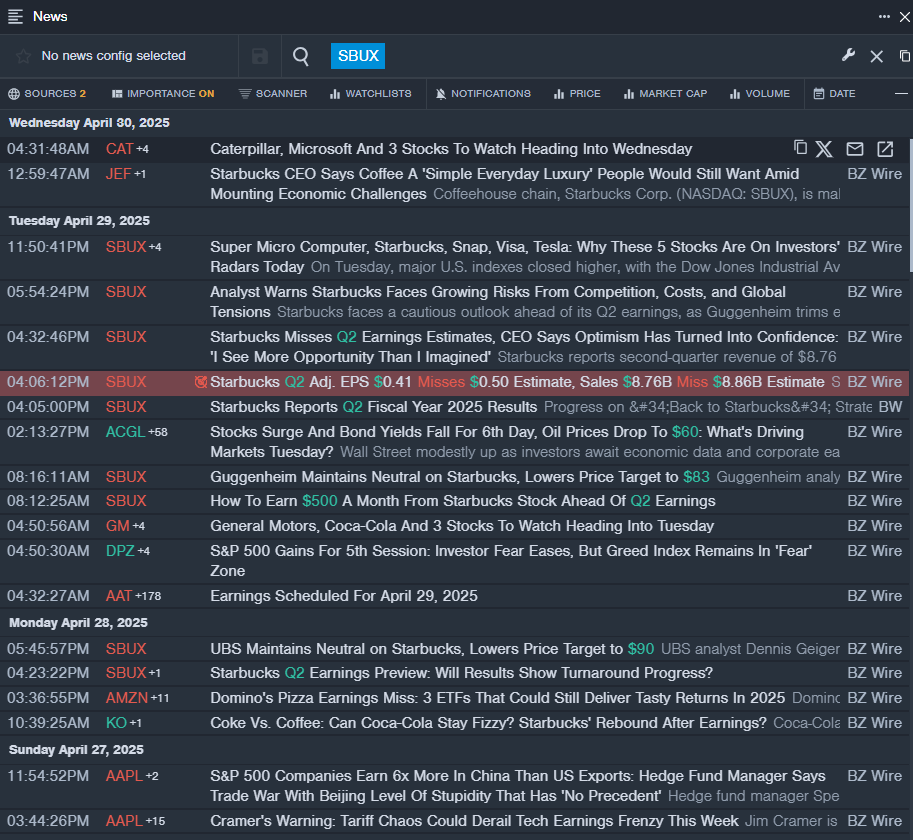

Starbucks Corporation (NASDAQ:SBUX)

- Dividend Yield: 2.88%

- Guggenheim analyst Gregory Francfort maintained a Neutral rating and cut the price target from $95 to $83 on April 29, 2025. This analyst has an accuracy rate of 68%.

- UBS analyst Dennis Geiger maintained a Neutral rating and lowered the price target from $105 to $90 on April 28, 2025. This analyst has an accuracy rate of 66%.

- Recent News: Starbucks reported weaker-than-expected second-quarter financial results after the closing bell on Tuesday.

- Benzinga Pro’s real-time newsfeed alerted to latest SBUX news.

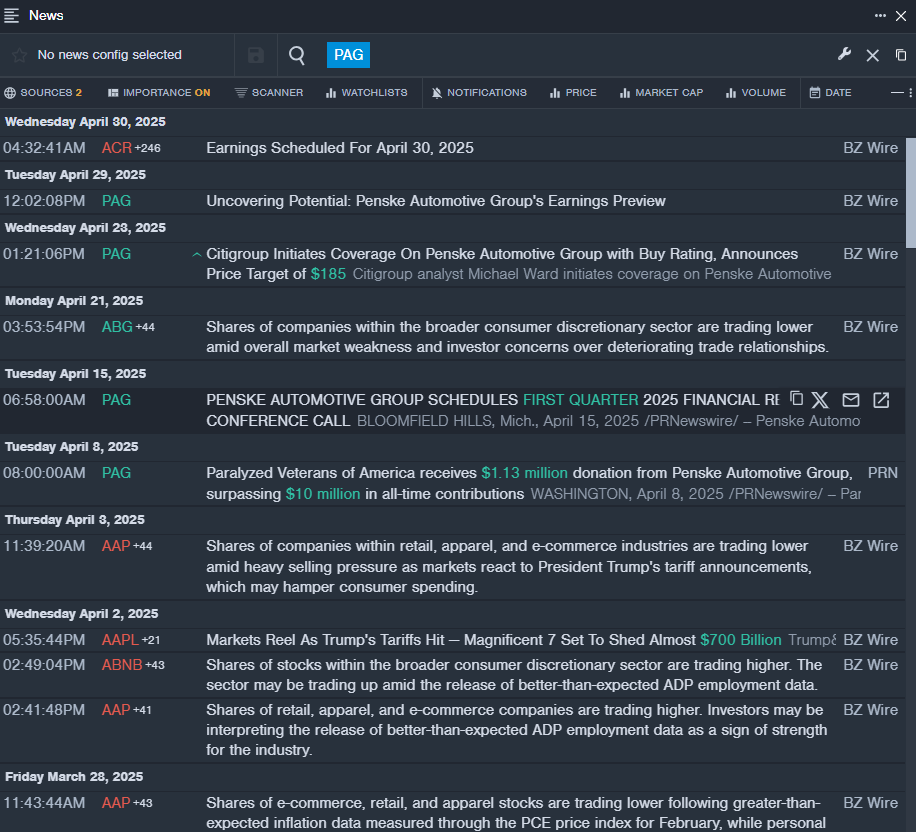

Penske Automotive Group, Inc. (NYSE:PAG)

- Dividend Yield: 2.82%

- Citigroup analyst Michael Ward initiated coverage on the stock with a Buy rating and a price target of $185 on April 23, 2025. This analyst has an accuracy rate of 76%.

- JP Morgan analyst Rajat Gupta maintained an Underweight rating and cut the price from $165 to $140 on March 27, 2025. This analyst has an accuracy rate of 73%.

- Recent News: Penske Automotive Group will release financial results for the first quarter on Wednesday, April 30.

- Benzinga Pro's real-time newsfeed alerted to latest PAG news

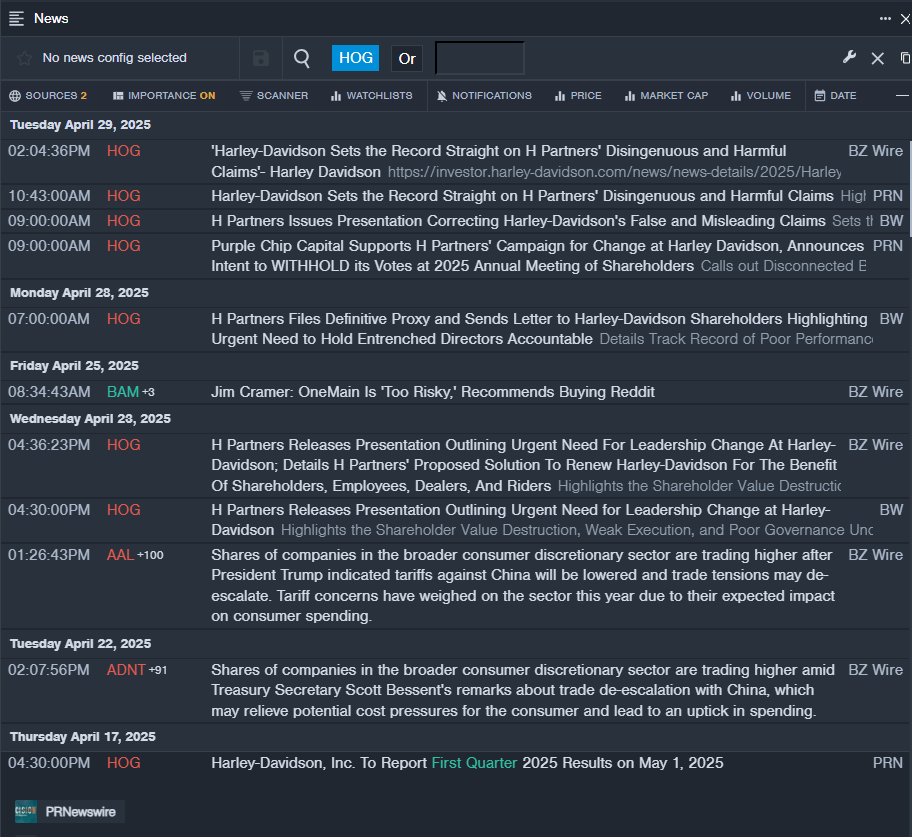

Harley-Davidson, Inc. (NYSE:HOG)

- Dividend Yield: 3.11%

- Citigroup analyst James Hardiman maintained a Neutral rating and cut the price target from $29 to $28 on April 2, 2025. This analyst has an accuracy rate of 61%.

- UBS analyst Robin Farley maintained a Neutral rating and slashed the price target from $35 to $28 on Feb. 20, 2025. This analyst has an accuracy rate of 79%.

- Recent News: Harley-Davidson will release its first quarter financial results before the opening bell on Thursday, May 1.

- Benzinga Pro’s real-time newsfeed alerted to latest HOG news

Read More:

Photo via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Earnings News Dividends Price Target Pre-Market Outlook Markets Analyst Ratings Trading Ideas