Wall Street's Most Accurate Analysts Give Their Take On 3 Defensive Stocks With Over 3% Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the consumer staples sector.

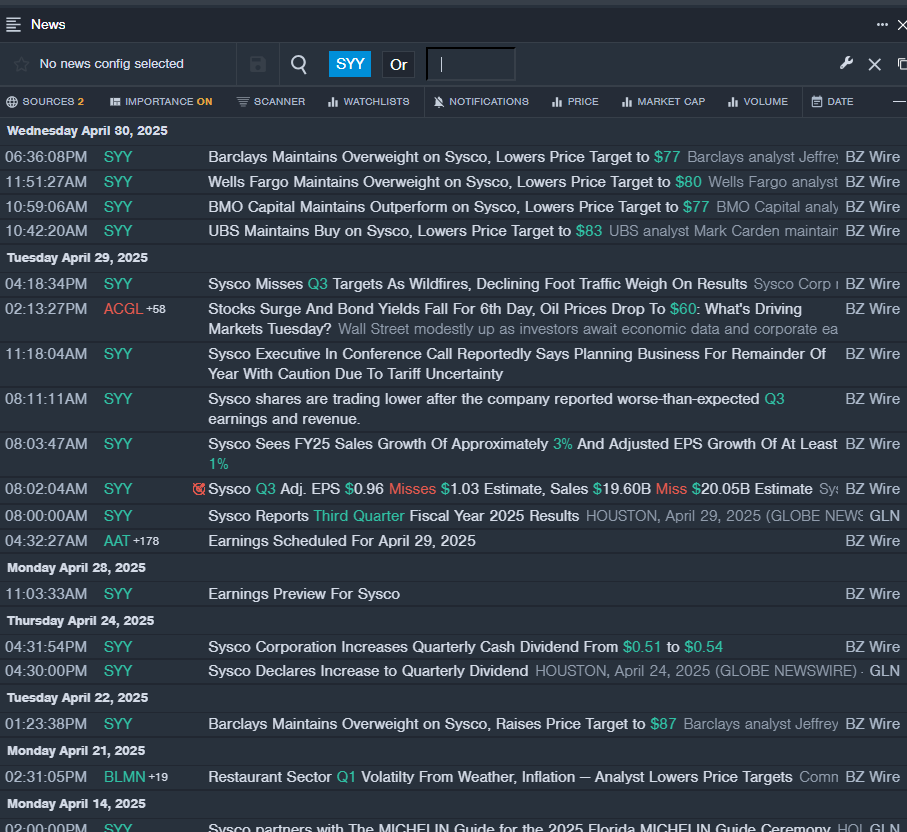

Sysco Corporation (NYSE:SYY)

- Dividend Yield: 3.03%

- Barclays analyst Jeffrey Bernstein maintained an Overweight rating and cut the price target from $87 to $77 on April 30, 2025. This analyst has an accuracy rate of 64%.

- Wells Fargo analyst Edward Kelly maintained an Overweight rating and lowered the price target from $87 to $80 on April 30, 2025. This analyst has an accuracy rate of 64%.

- Recent News: On April 29, Sysco reported worse-than-expected third-quarter earnings and revenue.

- Benzinga Pro’s real-time newsfeed alerted to latest SYY news.

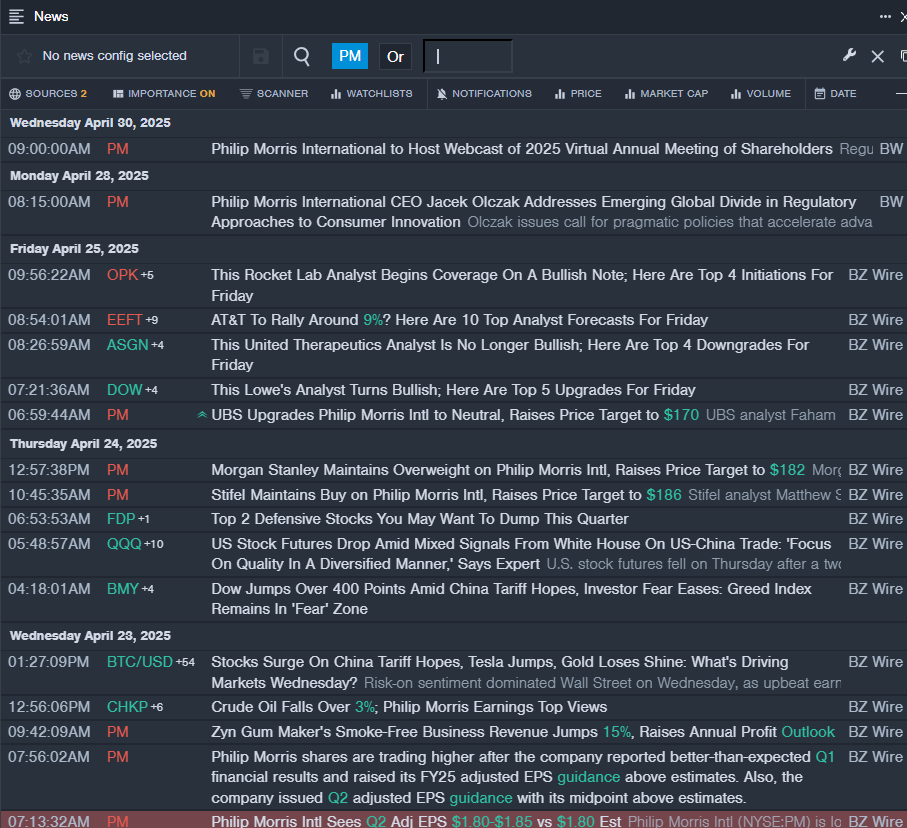

Philip Morris International Inc. (NYSE:PM)

- Dividend Yield: 3.15%

- Stifel analyst Matthew Smith maintained a Buy rating and increased the price target from $168 to $186 on April 24, 2025. This analyst has an accuracy rate of 61%.

- Barclays analyst Gaurav Jain maintained an Overweight rating and boosted the price from $145 to $175 on Feb. 26, 2025. This analyst has an accuracy rate of 66%.

- Recent News: On April 23, Philip Morris reported better-than-expected first-quarter financial results and raised its FY25 adjusted EPS guidance above estimates.

- Benzinga Pro's real-time newsfeed alerted to latest PM news

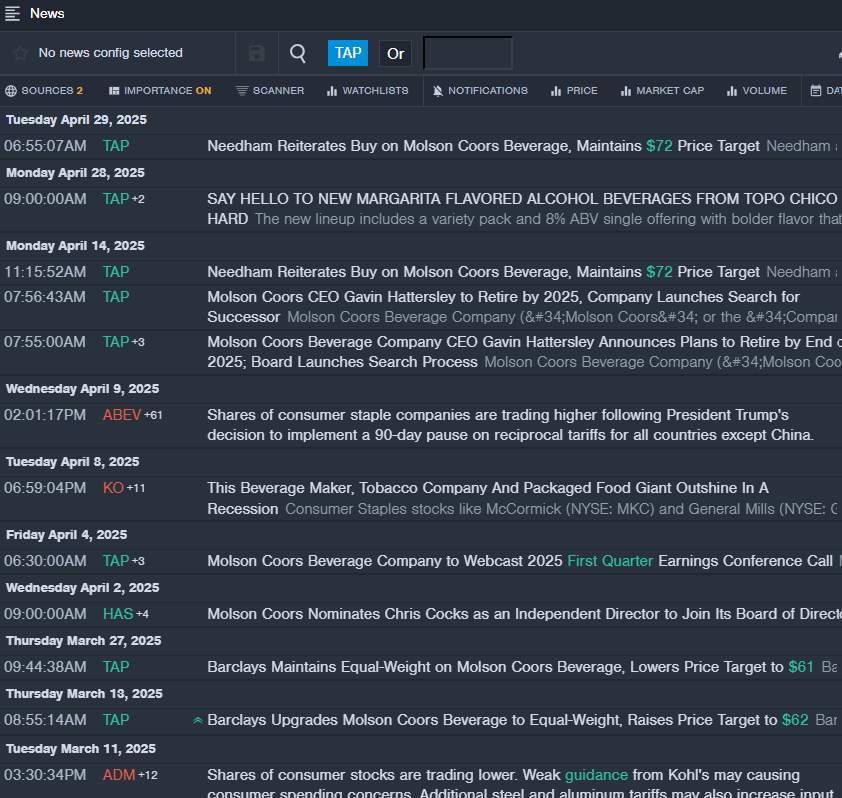

Molson Coors Beverage Company (NYSE:TAP)

- Dividend Yield: 3.27%

- Barclays analyst Lauren Lieberman maintained an Equal-Weight rating and cut the price target from $62 to $61 on March 27, 2025. This analyst has an accuracy rate of 64%.

- Morgan Stanley analyst Dara Mohsenian maintained an Equal-Weight rating and raised the price target from $60 to $63 on Feb. 14, 2025. This analyst has an accuracy rate of 73%.

- Recent News: On April 14, Molson Coors Beverage's CEO Gavin Hattersley announced plans to retire by the end of 2025.

- Benzinga Pro’s real-time newsfeed alerted to latest TAP news

Read More:

Photo via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: defensive dividend yieldNews Dividends Price Target Markets Analyst Ratings Trading Ideas