Analyst Color On Alcoa Ahead Of Earnings Report

Alcoa announces earnings after the close Tuesday, April 8. Pundits consider this the unofficial start to the earnings season.

Analysts expect Alcoa to report first quarter EPS of $0.05 on revenue of $5.56 billion, compared to last year’s EPS of $0.11 on revenue of $5.83 billion.

Those monitoring Alcoa’s performance are uneasy around the expected price movement of Alcoa in the face of raising aluminum prices and growth concerns in China and other overseas regions.

JP Morgan: “In aluminum, AA is targeting 5 percentile points improvement (from 43rd to 38th) on the cost curve in 2013-16, driven by restructuring smelters, modernization, Ma’aden, and productivity gains.” JP Morgan currently has an Overweight rating on Alcoa with a price target of $15.00.

S&P Capital IQ: “Our negative view is predicated on Bloomberg consensus forecasts that the price of aluminum will average about about $0.83/lb in 2014, following a decline (from 2012) to $0.88 in 2013.” CapIQ maintains a Hold position with a price range of $9.00 to $15.00.

Zacks Research highlighted that Alcoa’s revenues dropped roughly 5.3 percent to $5,585 million in Q4 2013. According to the report, Alcoa has been struggling to maintain growth in the face of their own predictions for aluminum demand to increase 7% for FY14.

Deutsche Bank: “We believe that by now industrial metals have priced-in a weaker Chinese growth outlook...with any “mini-stimulus” measure potentially limiting or even reversing further declines.” said the firm in an April 6, 2014 Markets Research release. In the same release, Deutsche Bank raised its price target on Alcoa from $7.50 to $10.00 and upgraded the rating from Sell to Hold.

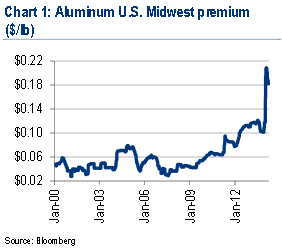

Aluminum has had its own fantastic price appreciation which is straining Alcoa’s margins:

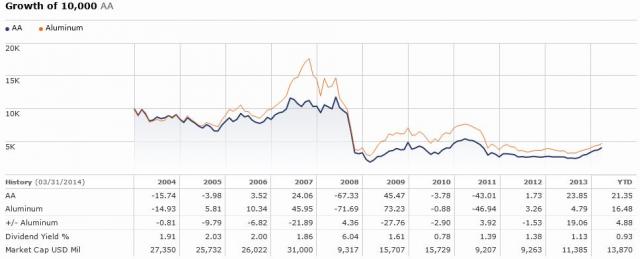

MorningStar Direct shows the return performance of $10,000 in Alcoa and/or Aluminum since 2004:

Latest Ratings for AA

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Deutsche Bank | Maintains | Hold | |

| Mar 2022 | Jefferies | Maintains | Buy | |

| Mar 2022 | JP Morgan | Maintains | Overweight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Deutsche Bank JP MorganAnalyst Color Earnings News Previews Analyst Ratings Trading Ideas