Citi Raises Yum Estimates, PT Following Quarter Results

In a report published Monday, Citigroup analyst Gregory Badishkanian raised the price target on Yum! Brands (NYSE: YUM) from $75.00 to $85.00 following the company's first quarter results.

Summary of SSS Across Divisions

Yum! Brands reports a $0.03 EPS beat with its China division SSS delivering inline results. The company noted that SSS momentum in China has continued into the second quarter. Management sees high-single-digit to double-digit same-store-sales growth with CRM at 17 percent. Operating profit for China is expected to grow 40 percent.

Weather was blamed for Taco Bell's same-store sales -1 percent results compared with the forecasted gain of 1.9 percent. Despite the quarter's results, Yum! Brands is optimistic following the initial results of the Taco Bell breakfast launch and expects to see SSS benefits in the second quarter.

KFC's same-store sales came in slightly under expectations at one percent. The company expects the division's operating profit to grow above 10 percent.

Pizza Hut's SSS came in at -2 percent compared with the expected +2 percent. Yum! Brands noted that the new hand-tossed pizza was overshadowed by competitor's “value-focused” ads. Operating profit should grow below eight percent.

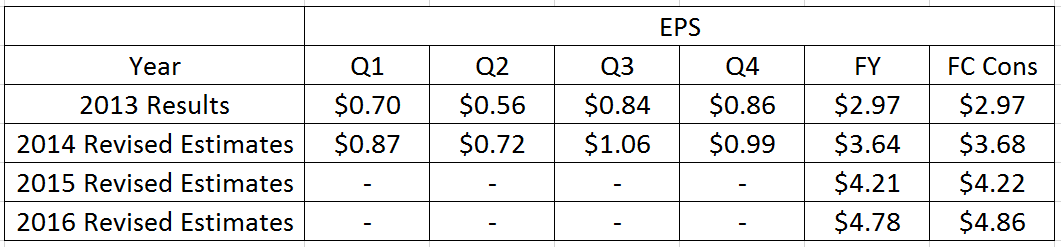

Citigroup Raises Estimates

Badishkanian wrote, “Given updated guid and trends, we're raising our '14- '16 EPS ests by 6c, 9c, and 9c each, respectively. Raising target price by $10.”

Latest Ratings for YUM

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Cowen & Co. | Upgrades | Market Perform | Outperform |

| Dec 2021 | Barclays | Maintains | Equal-Weight | |

| Dec 2021 | Atlantic Equities | Upgrades | Neutral | Overweight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Citigroup Gregory BadishkanianAnalyst Color Price Target Analyst Ratings