Why Morgan Stanley Thinks The Oil Services Sector Will Evolve To Survive Collapse In Crude Prices

A new report by Morgan Stanley looks at how the crash in oil prices will transform the oil services industry in the long-term. Analysts believe that a period of consolidation in the sector will lead to a healthier, stronger industry with higher margins once oil prices recover.

Halliburton/Baker Hughes Deal

Despite the possibility that Halliburton Company’s (NYSE: HAL) recent acquisition of Baker Hughes Incorporated (NYSE: BHI) raises antitrust concerns, analysts believe that the deal will be approved. The new company would be the largest oil services company, with an estimates $57 billion in sales in 2014 versus $49 billion for Schlumberger NV (NYSE: SLB). Analyst Ole Slorer sees a massive amount of market share split between post-deal Halliburton and Schlumgerger.

"We estimate that HAL/BHI and Schlumberger would together have 62% market share of technology-driven segments, and in parts of the world, especially in deepwater, would resemble a duopoly."

Open Door For Higher Margins

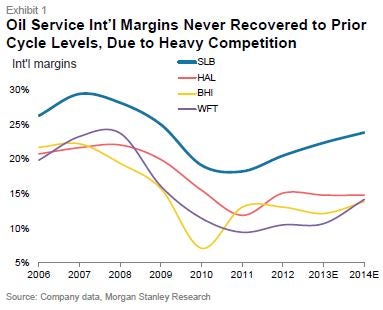

Despite the short-term pressure that falling oil prices have placed on the oil services industry, Morgan Stanley sees the potential for a strong recovery down the line. During the recent boom, margins in the sector never fully recovered to levels previously seen during cyclic highs.

Analysts believe a major reason for this lag may be the fierce competition in the space, a factor that would be reduced if an era of heavy consolidation is on the way.

What’s Next?

If the Halliburton/Baker Hughes deal is approved, analysts believe that Schlumberger could respond with expansion of its own. In addition, the new Halliburton might be required to divest billions of dollars of assets to meet antitrust requirements, a process that could create big opportunities for other companies in the space.

Overall, Morgan Stanley sees Schlumberger and Weatherford International PLC (NYSE: WFT) as the biggest near-term beneficiaries of the current environment.

Latest Ratings for HAL

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | Morgan Stanley | Maintains | Overweight | |

| Jan 2022 | JP Morgan | Upgrades | Neutral | Overweight |

| Jan 2022 | Morgan Stanley | Upgrades | Equal-Weight | Overweight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Morgan Stanley Ole SlorerAnalyst Color Long Ideas Commodities Markets Analyst Ratings Trading Ideas