Morgan Stanley: Casual Dining Is Picking Up

A recent report by Morgan Stanley presents the case that 2015 could be a great year for restaurant stocks. Analysts believe that there is no need to be skeptical of the recent positive turn in casual dining trends, as they believe the uptick in traffic is due to strengthening underlying demand.

Traffic Jam

The bad news up front for restaurants is that casual dining traffic has fallen for eight consecutive years. Over-capacity and a shift toward fast food have driven casual dining traffic 15 to 25 percent below peak 2006 numbers in mature casual restaurants such as Cheesecake Factory Inc (NASDAQ: CAKE) and Brinker International, Inc. (NYSE: EAT). However, analysts see a return to minimal (up to 1 percent) traffic growth in 2015.

Demographic Shifts

Analysts see big demand in the restaurant space coming from the Millennial generation over the next 10 years. Millennials are now entering their peak spending years, and they spend a disproportionately high percentage of their income on restaurants compared to previous generations. Analysts believe that this demographic shift will favor casual dining restaurants that target a younger crowd, while restaurants that target more mature customers will have to contend with a shrinking customer base.

Cheap Gas

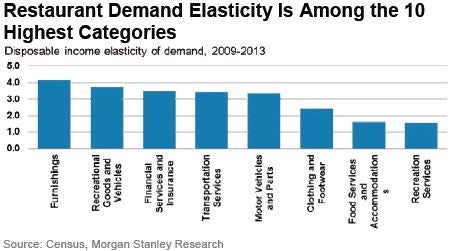

Morgan Stanley analyst John Glass believes that casual dining restaurants will benefit from low gas prices more than other sectors of the economy. "Restaurant demand elasticity to disposable income is among the top 10 spending categories, suggesting cash saved at the pump disproportionately impacts restaurant sales."

Glass believes that the effect of cheap gas will be strongest in low-income areas where the cost of gas represents a higher percentage of disposable income.

Stock Picks

Morgan Stanley chooses the following stocks as its top picks to bet on casual dining: Chipotle Mexican Grill, Inc. (NYSE: CMG), Starbucks Corporation (NASDAQ: SBUX), Buffalo Wild Wings (NASDAQ: BWLD), Cheesecake Factory and Brinker.

Latest Ratings for CAKE

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Morgan Stanley | Maintains | Underweight | |

| Feb 2022 | Wedbush | Maintains | Outperform | |

| Feb 2022 | Stephens & Co. | Maintains | Overweight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: John Glass Morgan StanleyAnalyst Color Long Ideas Restaurants Analyst Ratings Trading Ideas General