And MLV's Top Multifamily REIT Pick Is...

MLV & Co. REIT analyst Ryan Meliker attended the recent 2015 National Multifamily Housing Conference and issued a research note on January 23, with several key takeaways noted below.

The information gleaned from the conference also contributed to the selection of a top pick from among: (AIMCO) Apartment Investment and Management Co (NYSE: AIV), Associated Estates Realty Corporation (NYSE: AEC), Preferred Apartment Communities Inc. (NYSE MKT: APTS) and Essex Property Trust Inc (NYSE: ESS).

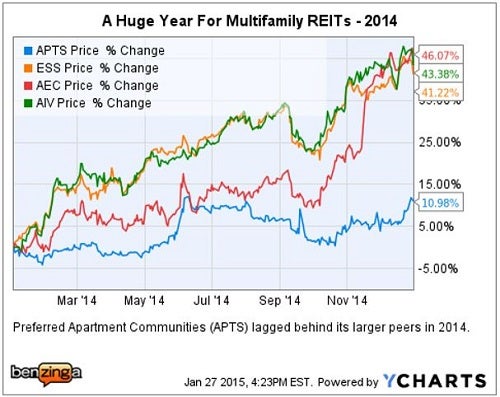

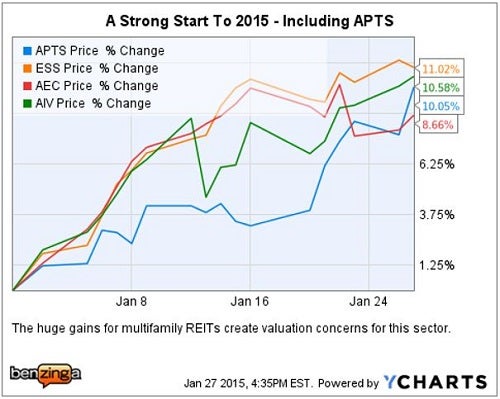

Tale Of The Tape

MLV & Co. Top Pick - 2015

- Preferred Apartment Communities (APTS) is the top multifamily pick for 2015. MLV & Co. maintains a Buy rating and a year-end 2015 PT of $12 -- representing a 20 percent upside. APTS currently pays investors a dividend yielding just over 7 percent.

- This small cap REIT, (just under $200 million), along with multifamily communities also investments up to 20 percent of its assets in "related investments such as grocery-anchored necessity retail properties."

- Additionally, APTS also finances new apartment community developments as part of its business strategy and "may enter into forward purchase contracts or purchase options for to-be-built multifamily communities…"

- Notably, on January 12, Preferred Apartment Communities announced that it intends to close on two multifamily communities in Houston, Texas totaling 520 units, for an aggregate price of $76 million.

Key NMHC Conference Takeaways

1. Looking ahead to 2015 and 2016, expect foreign capital investment in U.S. multifamily properties to continue. This trend will contribute to cap rate compression, making it more difficult for REITs to acquire properties that would be accretive to earnings.

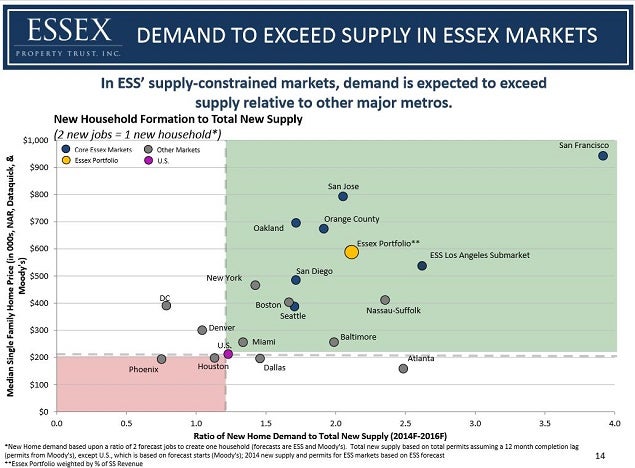

2. The West Coast: is expected to lead the country in job generation, which will help drive growth in rents during 2015. San Francisco is expected to see rent increases in the 7 to 8 percent range, while other strong markets included: Portland, Seattle, San Diego and Los Angeles.

This is expected to benefit Essex, essentially a pure-play on major west coast markets:

(Source: Essex November 2014 Presentation)

3. The Northeast: is split between outperformers (NYC and Boston, forecasted 3 – 4% rent growth) and underperformers (DC, Philadelphia, and Baltimore, forecasted 0 – 1% rent growth).

4. The Southeast: saw Florida with rent gains of 5 to 7 percent and occupancy above 94 percent in 2014. Strongest markets for 2015 included: Atlanta, Central and South Florida and Raleigh; with Charlotte and Nashville expected to lag.

APTS notably has a strong presence in the Atlanta market.

5. The Midwest: Chicago is "steadily improving" with 3 to 4 percent rent increases anticipated in 2015. Detroit is expected to see ~3 percent rent growth; with Indianapolis (supply), Kansas City and Minnesota seeing slower rent growth. (Despite Minnesota seeing lowest unemployment of top 25 urban markets).

6. The Southwest: Denver is forecast to have 4 to 5 percent rent growth, with Austin, Dallas and Phoenix also expected to show strong growth in the 3.5 to 4.5 percent range. The short-term outlook (2015) for Houston still remains positive, with projected rent growth in the 3 to 4 percent range.

However, if the price of oil were to remain below $50 per barrel for an extended length of time (12 to 18 months or more), "it would create systemic problems in the region and be possibly devastating to the multifamily market."

"Conference participants agreed that Houston was in for difficult times ahead – there was no sugar coating how oil prices might affect job growth and therefore demand for multifamily housing."

Bottom Line

Overall demand in 2015 for multifamily is up, "which is driven by a stronger economy, a steady shift away from home ownership, a sustained period of job growth, and an overall solidity in domestic GDP."

Latest Ratings for APTS

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | JonesTrading | Downgrades | Buy | Hold |

| Sep 2021 | JMP Securities | Maintains | Market Outperform | |

| Aug 2021 | JonesTrading | Maintains | Buy |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: MLV & CoAnalyst Color Long Ideas REIT Top Stories Analyst Ratings Trading Ideas Real Estate Best of Benzinga