HOT Spin-Off Turns Morgan Stanley On

Morgan Stanley released a research note on February 12, updating its views on Starwood Hotels & Resorts Worldwide Inc (NYSE: HOT).

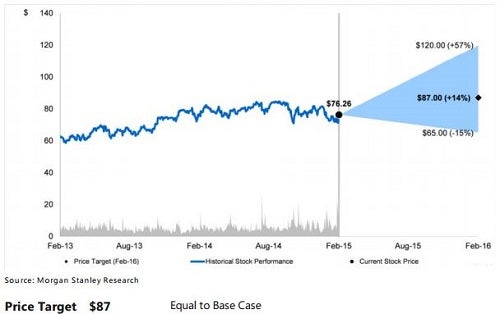

Morgan Stanley reiterated its HOT Outperform rating and $87 PT (base case), which would represent a 16 percent 2015E return from $76.26 closing price on February 11.

Risk-Reward Snapshot - Starwood

- MS bull case: PT of $120 assumes 15.4x 2016E EBITDA ($1.410 billion) - "Improving Global Economy drives strong RevPAR beat, unit growth re-accelerates."

- MS base case: PT of $87 assumes 13.4x 2016E EBITDA ($1.245 billion) - "Strong Industry Fundamentals, though Some Weakness Int'l."

- MS bear case: PT of $65 assumes 11.6x 2016E EBITDA ($1.113 billion) - "Stuttering Economies Drive Below Range RevPAR Growth, Unit Growth Slows Further."

Fundamentals

- Starwood 5 to 7 percent CC 2015 RevPAR guidance is now in line with peers Marriott International, Inc. (NYSE: MAR) and Hilton Worldwide Holdings, Inc. (NYSE: HLT).

- Starwood's group business had strongest booking month ever in December 2014.

- MS expects that operating leverage from Starwood's owned segment leads EBITDA estimate to high-end of guidance.

- Notably, Starwood has beaten the high-end of quarterly EBITDA guidance for nine quarters in a row.

Value Creation

MS noted in the past Starwood has been inconsistent with buybacks ($0 Q1 2014) and asset sales ($0 Q3 2014); without guidance.

Now Starwood provided guidance and is executing on both:

- Starwood has already repurchased $75 million of stock, ($300 - $350 million annual guidance).

- Starwood gave guidance of ~$800 million of asset sales, (several hotels are already on the market).

- Spin-off of timeshare business and sale of hotels should "drive the market to properly value these segments."

Risks

- Macro-economic challenges do not improve, leading to softer global demand.

- Foreign exchange (FX) headwinds (Starwood has 50 percent international exposure vs. Marriott/Hilton ~20 percent).

- Cost pressures - (healthcare, insurance and property taxes) limit margin increases/incentive fee gains.

- Recent underperformance of "luxury/upper upscale U.S. hotels."

Dividends

Starwood's annual dividend is currently $1.50 per share.

The MS 16 percent base case gain assumes 14.1 percent price appreciation in shares, plus the dividend.

Image credit: Russavia, Wikimedia

Latest Ratings for HOT

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Sep 2016 | Citigroup | Terminates Coverage On | Neutral | |

| Aug 2016 | Citigroup | Maintains | Neutral | |

| Jul 2016 | Canaccord Genuity | Terminates Coverage On | Hold |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Morgan Stanley's (MS)Analyst Color Long Ideas Reiteration Analyst Ratings Trading Ideas Real Estate Best of Benzinga