Self-Storage REIT Expert: Expect 'Another Robust Year'

On Monday, Cantor Fitzgerald published a note containing key takeaways on the self-storage sector from an interview with Aaron Swerdlin, executive managing director with Cantor Fitzgerald affiliate NGKF Capital Markets.

Cantor Fitzgerald covers all four publicly-traded self-storage REITs:

- CubeSmart (NYSE: CUBE) – Buy rated; $23.50 PT

- Extra Space Storage, Inc. (NYSE: EXR) – Hold rated; $57.50 PT

- Public Storage (NYSE: PSA) – Buy rated; $199 PT

- Sovran Self Storage Inc (NYSE: SSS) – Hold rated; $89 PT

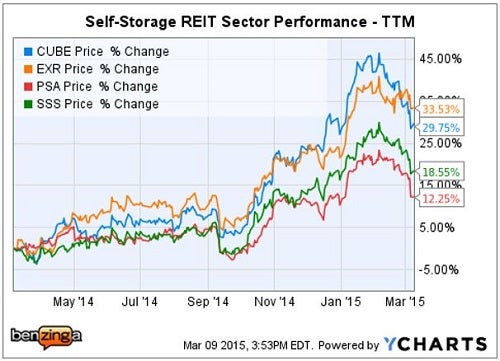

Tale Of The Tape – Past Year

No updates or price target changes were included in the Cantor Fitzgerald note.

Cantor Fitzgerald – Self-Storage Overview

Cantor remains overweight the sub-sector, noting that self-storage REITs "have out-performed broader markets in the last few years driven by 1) robust consumer demand, 2) limited new supply, 3) increasingly sophisticated revenue management systems and 4) technology advantages over private/smaller owner/operators."

Cantor Fitzgerald – Swerdlin Key Takeaways

Outlook – Depends On Pricing Power:

- Cantor noted, "As occupancy approaches historical high levels, Mr. Swerdlin believes that pricing (especially renewals) should drive growth."

- Swerdlin "believes that optimum occupancy is in a range of 89 - 91 percent (average) and leads to revenue maximization."

- "Private operators pricing," he added, "remains well below public REITs pricing driven by lack of revenue management systems, technology, and the conservative nature of private operators."

- This gap might dampen public REIT pricing power.

- "On the expense side, the biggest variable is property taxes — as [Cantor] had expected."

Supply – Remains In-Check (For Now):

- Swerdlin "expects net absorption to remain positive in the sub-sector driven by robust demand drivers (e.g., population growth)."

- "In attractive, high barrier markets (e.g. New York, San Francisco), land prices remain competitive. As such, secondary and tertiary markets could see more development."

- "Construction financing is disciplined as compared to pre-financial crisis levels with equity in the form of cash being the primary requirement. Terms include rates that are 300-500bps over LIBOR, 3 - 5 year term with two one-year extensions available and 25 - 35 percent equity."

- "Development yields stand at approximately 8 - 10 percent—attractive as compared to market cap rates."

- "While there has been an uptick in 'certificate of occupancy' deals [...] Swerdlin doesn't expect it to grow due to risks associated with delivery 2-3 years from now."

More Transactions, Lower Deal Size:

- "In 2014, the self-storage sector saw transactions valued at approximately $2.0 billion." In 2015, due to fewer large portfolios, Swerdlin "expects transactions at approximately $1.5 - 1.8 billion range with larger number of transactions and deals in a range of $50 - 70 million."

- "As the deal volume slows in the top 10 MSAs, more capital is flowing into top 25 MSAs."

- "Buyers include public REITS, private equity, pension funds, hedge funds, et cetera, while sellers include institutional partners/funds reaching the end of holding periods."

- In Swerdlin's view, typical underwriting on a $50 million deal "includes: 55 - 70 percent leverage, 2 - 5 year interest only loan with all in coupon in a range of high 3s (floating) to low 4s (CMBS) and 5 - 7 year holding period."

- Stabilized cap rates stand in a range of 5.75 - 6.50 percent with exit cap rates approximately 100bps higher assuming a 5-year holding period."

- Image credit: Ed Chambliss, Wikimedia

Latest Ratings for CUBE

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Dec 2021 | Truist Securities | Maintains | Hold | |

| Dec 2021 | Raymond James | Upgrades | Market Perform | Outperform |

| Oct 2021 | Berenberg | Initiates Coverage On | Hold |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Aaron Swerdlin Cantor FitzgeraldAnalyst Color REIT Analyst Ratings General Real Estate Best of Benzinga