Why Wunderlich Now Loves Rexford Industrial

Wunderlich Securities on April 2 initiated coverage on Rexford Industrial Realty (NYSE: REXR) with a Buy rating in a brief research note, "A SoCal Industrial Pure Play We Like."

During the past 52 weeks, Rexford Industrial has traded in a range of $12.78 to $16.66 per share.

Rexford shares closed up modestly on the day Wunderlich published its recommendation.

Tale Of The Tape

Rexford Industrial has a market cap of $870 million, making it relatively easy for this REIT to move the needle by either accretive acquisitions or organic growth.

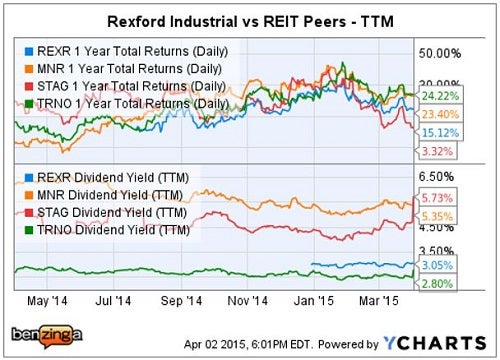

There are three other small-cap industrial REITs often viewed as Rexford's peers. They each have a highly focused strategy, or significant tenant concentration, which differentiates them from other industrial REIT business models.

- Monmouth R.E. Inv. Corp. (NYSE: MNR) - $650 million cap; Monmouth continues to grow primarily by acquiring new single-tenant build-to-suit industrial properties. Approximately 50 percent of MNR's rental income comes from a single tenant, FedEx. Monmouth has no West Coast assets.

- STAG Industrial Inc (NYSE: STAG) - $1.5 billion cap; STAG, or Single Tenant Acquisition Group, is uniquely focused on owning Class-B facilities leased to creditworthy tenants in secondary markets in the Midwest, Northeast and Southern U.S. markets.

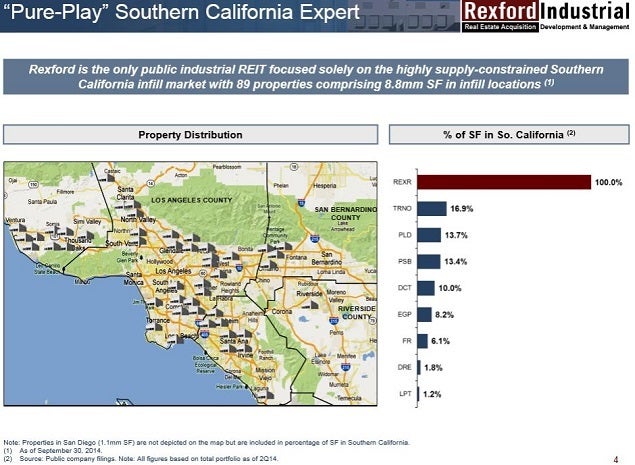

- Terreno Realty Corporation (NYSE: TRNO) - $980 million cap; Terreno is focused on six major port markets: LA/Long Beach, Northern New Jersey/New York City, Miami, Seattle, San Francisco Bay Area and Washington D.C./Baltimore.

Another differentiator for Rexford is that it has a mixture of both single-tenant and multi-tenant properties.

Rexford Industrial, Buy $19 PT

Wunderlich feels its $19 price target is "in line with [its] NAV estimate of $19.02 (5.5% portfolio cap rate) vs. industrial REIT peers trading at 97%."

Wunderlich cited the following factors to support its analysis:

- An attractive relative valuation.

- Significant lease rollover into a strong market.

- An occupancy upside, "that at market levels would equate to an incremental $1.36 of NAV relative to [the Wunderlich] estimate.

Wunderlich believes Rexford's management "has targeted a niche wherein consistent shareholder value can be created due to a deep understanding of the market and significant research capacities, giving REXR the ability to persistently source accretive off-market deals."

The Wunderlich $19 price target represents ~17 percent upside from the REXR April 2 close of $15.73 per share.

Wunderlich's projected investor total return, including Rexford's current 3 percent annual dividend yield, would be just north of 20 percent.

Latest Ratings for REXR

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Dec 2021 | JP Morgan | Upgrades | Neutral | Overweight |

| Jul 2021 | Capital One | Upgrades | Equal-Weight | Overweight |

| Jun 2021 | Wells Fargo | Maintains | Equal-Weight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Wunderlich SecuritiesAnalyst Color REIT Price Target Initiation Analyst Ratings General Real Estate Best of Benzinga