Expert: Traders Will Make 'A Lot Of Money' From This Market Transition

Benzinga recently had a chance to speak with John Canally, Senior Vice President and Economist at LPL Financial, about the current state of the U.S. economy following the disappointing March jobs report.

Canally discussed the upside remaining in the stock market, which sectors are his favorites and where he sees the next major profit opportunity for traders.

Upside Remaining

The S&P 500 is now about 33 percent higher than it was prior to the Financial Crisis. However, Canally told Benzinga that he sees room for further upside.

“We’re in the middle of an economic cycle, and usually the middle of an economic cycle means good news for earnings, and of course, earnings drives stock prices,” Canally explained.

“Stocks were cheap in 2009. They’re no longer cheap, but because of where we are in the business cycle, that suggests that we will get more gains in stocks from here despite the fact that we’re well past the prior peaks.”

According to Canally, the current business cycle is in the “sixth or seventh inning” and the cycle likely has at least two or three more years remaining.

Volatility Coming?

According to Canally, as a market cycle matures, volatility in stock prices tends to increase. “We’re long overdue for a 10 percent correction,” Canally told Benzinga.

As long as the business cycle continues, Canally believes that the “buy the dip” mentality will remain in place.

Key Transition

When asked about sectors of the market currently provide opportunities for investors, Canally listed Technology, Industrials, Health Care (particularly Biotech), and Consumer Discretionary. “I think the big turn this year where people can make a lot of money will be the turn from when consumer discretionary stops working and energy starts working.”

Canally believes that correctly timing this transition in the market correctly will offer a huge opportunity for traders.

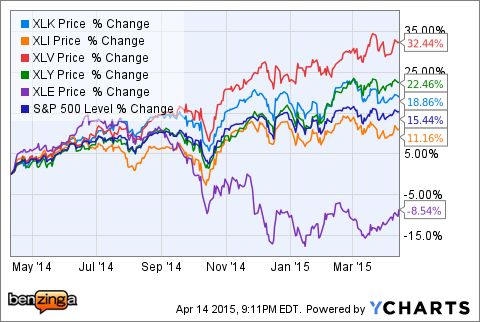

The Technology Select Sector SPDR ETF (NYSEMKT: XLK), the Industrial Select Sector SPDR ETF (NYSEMKT: XLI), the Health Care Select Sector SPDR ETF (NYSEMKT: XLV) and the Consumer Discretionary Select Sector SPDR ETF (NYSEMKT: XLY) are all up more than 11 percent in the past year.

Not surprisingly, the Energy Select Sector SPDR ETF (NYSEMKT: XLE) has lagged the market, falling more than 8 percent during that time.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Long Ideas Sector ETFs Top Stories Exclusives Trading Ideas Interview ETFs Best of Benzinga