New Study Shows Best Way To Play Rising Interest Rates

In a new report, analysts at Morgan Stanley shifted their prediction for the Federal Reserve’s first interest rate hike forward from March 2016 to December 2015.

Tough Choices

If this prediction is correct, investors have just eight months to decide how to position their portfolios for the transition from an environment of historically low interest rates to one where interest rates will likely slowly and steadily climb.

Rates may eventually reach a level where investment in bonds becomes more appealing. But until that time, investors will be looking for other places to put their money.

One Possibility: Oil

While stock valuations are at multi-year highs, oil prices are at their lowest levels since the Financial Crisis. Most analysts predict recovery in oil prices eventually, but the timing and magnitude of the recovery varies widely from analyst-to-analyst.

In the near-term, oil will likely continue its volatile trading pattern. The United States Oil Fund ETF (NYSE: USO) is down nearly 50 percent in the past year, but it has spiked more than 16 percent in the past month.

Stock Sectors

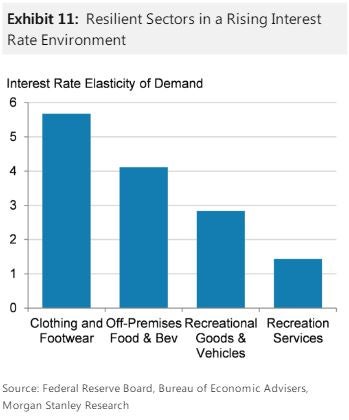

In Morgan Stanley’s report, analysts discussed sectors of the stock market that tend to perform well during periods of rising interest rates. These sectors include Clothing and Footwear, Off-Premises Food and Beverage, Recreational Goods and Vehicles, and Recreation Services.

Stocks that fall into these categories include Nike Inc (NYSE: NKE), V.F. Corp (NYSE: VFC), Under Armour Inc (NYSE: UA), Brunswick Corp (NYSE: BC), Polaris Industries (NYSE: PII), Harley-Davidson Inc (NYSE: HOG), Las Vegas Sands Corp (NYSE: LVS), Carnival Corp (NYSE: CCL) and The Walt Disney Co (NYSE: DIS).

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Long Ideas Specialty ETFs Economics Federal Reserve Analyst Ratings Trading Ideas ETFs Best of Benzinga