Activision Blizzard Preview: No Grand Results For 'Grand Theft Auto' Maker

Activision Blizzard, Inc. (NASDAQ: ATVI) will report first quarter financial results after the market closes.

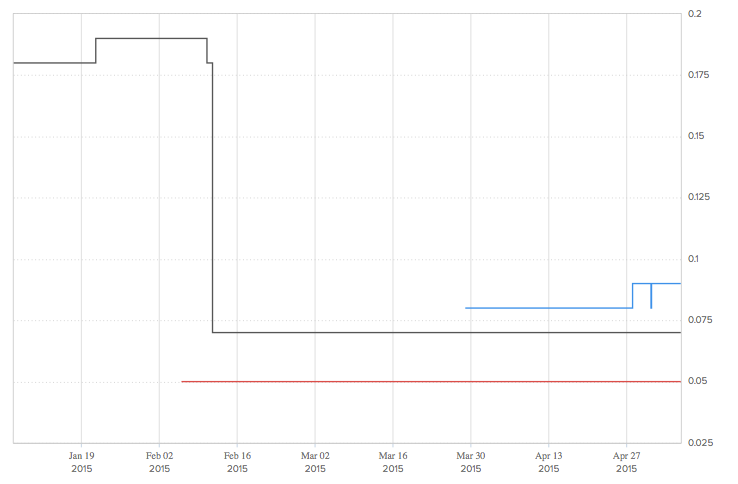

Although the crowd and the Street are expecting results above the company’s guidance, they anticipate substantial declines in relation to the last quarter and the first quarter of last year. According to Estimize, the company guided earnings of $0.05 per share on revenue of $640 million, while Wall Street analysts model consensus earnings of $0.07 per share on revenue of $656.71 million, and Main Street, earnings of $0.09 per share on revenue of $664.24 million.

Related Link: What Gaming Investors Need To See Before Earnings

This compares to earnings of $0.94 on revenue of $2.213 billion reported last quarter, and earnings of $0.19 on revenue of $772 million registered in the first quarter of 2014.

The graph above shows how actual earnings have compared to estimates and guidance over the past couple of years. The company has a record of beating both of them, usually by a small margin.

Another chart, featured below, illustrates the evolution of estimates over time.

While the Street saw its consensus fall substantially in February, settling at the current level, the crowd became more constructive in late-April, when it hit the present consensus.

The (Earnings) Call (Of Duty)

In a report published Monday, analysts at Credit Suisse previewed video game companies’ earnings. Regarding Activision, they said, “for 2Q15 and beyond we have modeled the following (in order of importance): 1) Added 3 million units of Guitar Hero Live, 2) removed Diablo III console along several other licensed titles, 3) modestly Reduced Skylanders and Call of Duty unit volume estimates."

According to a recent article, “The analysts ‘remain on the lookout’ for incremental changes to the releases scheduled for this year, since Activision is likely to announce one more franchise set for release in 2015.”

Credit Suisse maintains an Outperform rating and a $28 price target on the stock.

Latest Ratings for ATVI

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | Keybanc | Maintains | Overweight | |

| Jan 2022 | Raymond James | Downgrades | Outperform | Market Perform |

| Jan 2022 | Stifel | Maintains | Buy |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Call of Duty Credit SuisseAnalyst Color Previews Crowdsourcing Analyst Ratings Trading Ideas General