CyberArk Software Falls As Earnings Loom

Shares of Cyberark Software Ltd (NASDAQ: CYBR) were down on Thursday ahead of the company’s first quarter financial results, scheduled for after the market close.

According to Estimize, Wall Street analysts expect earnings of $0.05 per share on revenue of $26.08 million, in line with the company’s guidance. These results would imply an increase from the net loss of $(0.18) per share on revenue of $17.4 million reported in the first quarter of 2014, but a 76 percent decline from last quarter’s $0.21 per share (on revenue of $36.3 million).

Related Link: 3 Diverse Stocks This Expert Is Watching (In 3 Charts)

The crowd is more bullish on Cyberark’s results, and projects consensus earnings of $0.13 per share on revenue of $29.37 million.

The chart above shows a history of the company’s earnings over the past couple of years. Estimates were included only in the latest quarter, and beat by the company.

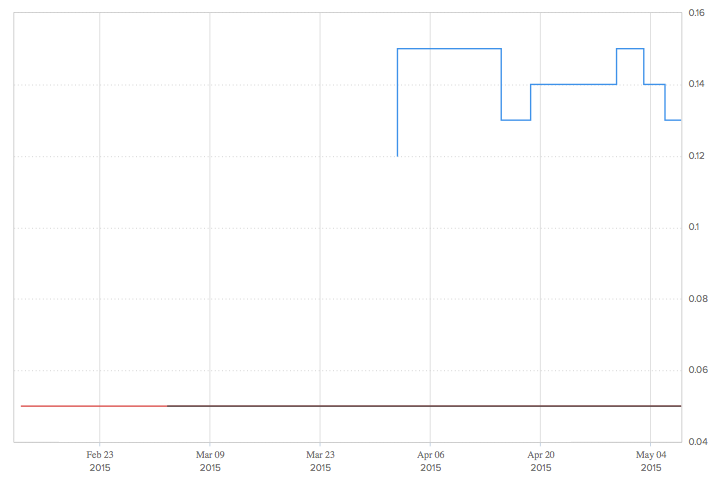

A second graph illustrates the evolution of sentiment over the past few months. Both Wall Street’s consensus estimate and the company’s guidance remained the same since February. The crowd’s consensus estimate went through some ups and downs before settling at $0.13.

A Secure Play?

Andrew Chanin, manager of the only pure-play cybersecurity ETF currently trading on the NYSE, was recently a guest on #PreMarket Prep. Among several cybersecurity names, the expert discussed CyberArk.

Chanin said, “feels the company saw a lot of ‘fanfare around the IPO.’ Chanin believes CyberArk ‘benefited from the timing of its IPO’ as investors were looking to deploy money in cyber security. He feels the recent public offering has kept CyberArk shares ‘on the front pages.’”

In a recent note, analysts at JMP Securities also commented on CyberArk. “After speaking with more than 20 industry contacts over the last two days, the most consistent theme we recognized was the accelerating demand for rapid detection and response solutions (what we refer to as internal security), as enterprises have come to the realization that preventing every breach is impossible,” the report said. “Our checks indicate privileged account management (PAM) in particular, which is a form of internal security, is evolving into a key spending priority, and we believe CyberArk is garnering a disproportionate share of that market.

Latest Ratings for CYBR

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Morgan Stanley | Maintains | Overweight | |

| Feb 2022 | Needham | Upgrades | Hold | Buy |

| Feb 2022 | Mizuho | Maintains | Buy |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Andrew Chanin EstimizeAnalyst Color Previews Crowdsourcing Analyst Ratings Trading Ideas General