Heard Of The 'Productivity Paradox'? Allow Goldman Sachs To Explain

In a new report, analysts at Goldman Sachs discuss what they are calling the “productivity paradox” in the U.S. economy. Analysts see relatively weak production growth in the U.S. but believe that the number might not accurately portray the true contribution from information technology.

The Numbers

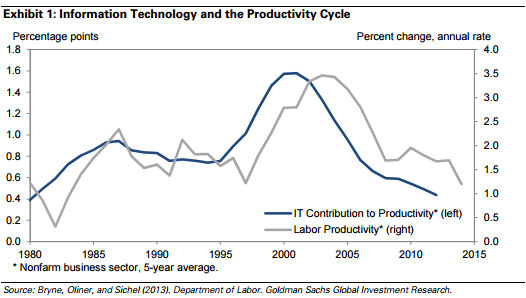

According to the report, Goldman has now reduced its working assumption for U.S. measured productivity growth to 1.5 percent. Analysts note that this “sluggish” rate is the same productivity growth rate that the U.S. economy experienced from 1973 to 1995 and is well below the long-term growth average of 2.25 percent.

A breakdown of the recent numbers shows that weakness in information technology is to blame for the current slump in productivity.

The Paradox

The so-called paradox comes from Goldman seeing no evidence that productivity is lagging. Profit margins are at record levels, inflation numbers have mostly come in lower than expected, equity prices have been on the rise for more than six years and the technology sector has outperformed the overall stock market.

“None of this feels like a major IT-led production slowdown,” analysts explain.

One Possible Explanation

Goldman believes that this paradox could come from the way that the U.S. GDP numbers are calculated. Quality-adjusted prices and real output are difficult to measure when it comes to software and digital content, and the result could be a “statistical understatement” of the contributions of growth in these two areas.

Takeaway

Goldman believes that indicators such as employment numbers are more reliable that GDP numbers when it comes to gauging the strength of the economy. Goldman also believes that the true inflation rate is even lower than the measured inflation rate, suggesting that there is a strong case for “continued accommodative monetary policy.”

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Entrepreneurship Psychology Econ #s Top Stories Economics Analyst Ratings General Best of Benzinga