Two Charts Explain Why Travelers Companies Is A 'Great Trade'

Market technician and founder of Eagle Bay Capital, JC Parets, tracks the movement and performance of the stocks in the Dow 30, looking into the companies every week.

Recently, Parets commented on Travelers Companies Inc (NYSE: TRV), a stock that his firm has liked "for a long, long time" – according to a recent report.

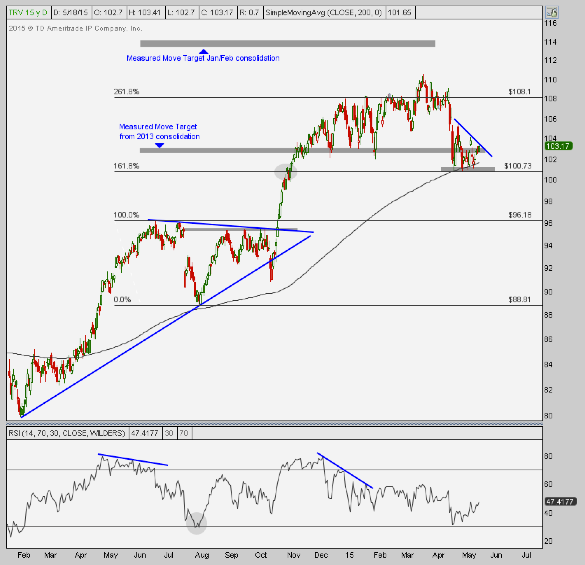

Weekly Chart

Structurally, the company continues to impress Eagle Bay, as the stock continues to make higher lows and higher highs. The firm suggested that "longs use late July lows as a stop," although tactically they recommended moving them up in November 2014 (see daily chart below).

Parets highlights that "relative strength broke out nicely above the downtrend from last year and momentum is in a very strong bullish range." His firm's initial target was hit in November, close to $103 "based on the measured move from the range in 2013." Parets continued, explaining that the stock then headed nicely towards Eagle Bay's ultimate target (and got there in March) up close to $110.76, which was based on the 261.8 perent Fibonacci extension from that range.

Daily Chart

Short term, in the fall, the analysts said it looked like a breakout was coming soon. Sure enough, in October the stock had "continued to bump up against this resistance from the downtrend from earlier this [2014] summer."

The firm "wanted to buy the breakout above the October highs and stay long only above that." The stock hit their $103 target (based on the measured move seen in the weekly timeframe in November).

"With momentum in a bullish range and a structurally bullish picture, this looked great and we've wanted to be a buyer of any weakness," Parets explained. Their tactical target was hit in January, just over $108 (261.8 percent Fibonacci extension from the summer's range).

Parets thus arrives to the conclusion that Travelers Companies is a great trade. "At this point I would be a buyer on a breakout above this consolidation over the past few week defined by this downtrend line from the late April highs. Below the April lows and no reason to be long. Target is back to 108," he explained.

Image Credit: Public Domain

Latest Ratings for TRV

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Morgan Stanley | Maintains | Equal-Weight | |

| Jan 2022 | Barclays | Downgrades | Overweight | Equal-Weight |

| Jan 2022 | Morgan Stanley | Maintains | Equal-Weight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Dow 30 Eagle Bay Capital JC ParetsAnalyst Color Long Ideas Technicals Analyst Ratings Trading Ideas