Cowen & Co. Data Center REITs, Rackspace: Key Conference Takeaways

On Friday, Cowen & Co. analyst Colby Synesael published highlights from its 43rd Annual Telecom, Media and Technology Conference.

The companies making presentations included:

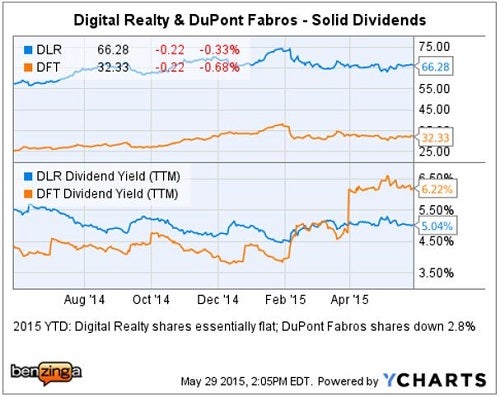

- Digital Realty Trust, Inc. (NYSE: DLR): Neutral Rating, $70 PT.

- DuPont Fabros Technology, Inc. (NYSE: DFT): Outperform Rating, $40 PT.

- Rackspace Hosting, Inc. (NYSE: RAX): Outperform Rating, $74 PT.

Tale Of The Tape: Data Centers

Tale Of The Tape: Rackspace Hosting

Rackspace shares took a big hit after reporting Q1 2015 earnings and updating FY 2015 guidance.

Rackspace has traded in a 52-week range of $28.80 to $56.20 per share; shares are down approximately 14 percent YTD.

Cowen–Rackspace: Key Takeaways

Presenter: CFO Karl Pichler

- 1. Deal Pipeline: While Pichler reported that the pipeline is "still healthy," Cowen is concerned that reported delays in "execution/closing deals" could impact FY 2015 if June bookings are not robust.

- 2. Capex: Pichler reiterated that "there should be a high correlation to revenue and capex guidance (trending towards 25 percent of revenue) this year, meaning that if the company hits the low-end of revenue guidance then capex will likely be <25 percent of revenue."

- 3. Churn: A large "one-of churn event" on April 1, will have a larger effect on Q2 2015 guidance than the bookings delays; management was unaware of the timing of this event when it reported Q1 guidance.

- 4. Cloud Partnership: Cowen still came away with the belief that an announcement of a deal with a major cloud provider could occur by the end of Q3 2015.

- 5. Cowen Incremental View = More Negative: "As it relates to the bookings delays related to some larger enterprise deals, management didn't really provide any color to explain why so unexpectedly the deal momentum seems to have just stopped which we still find surprising considering all the time/effort that has gone into building up its enterprise practice the last few years."

Cowen–Digital Realty: Key Takeaways

Presenters: CFO Andy Power, COO Jarrett Appleby, SVP Sales and Marketing Matt Miszewski

- 1. Colocation Business: Digital continues to make this a focus, targeting approximately 8 percent of revenues coming from colocation customers by 2017; "Management plans on augmenting their go-to-market strategy and also to expand their retail product offering to more data centers around the world," they reported.

- 2. M&A Criteria: "Power said he couldn't envision a scenario where Digital Realty made an acquisition that was not immediately accretive to core-FFO/share."

- 3. European Footprint: Management reiterated its goal to expand into the German market; although Cowen sees the U.S. markets as being "highest priority" right now. Cowen still views an Interxion acquisition as possible.

- 4. Investor Day: Digital "is currently developing a detailed strategic plan for the company and plan on rolling it out at their Analyst Day in Ashburn, Virginia on September 15th."

- 5. Cowen Incremental View = More Positive: Cowen did not elaborate on its rationale.

Cowen –DuPont Fabros: Key Takeaways

Presenter: CFO Jeff Foster

- 1. Facebook Inc (NASDAQ: FB) Deal: "Last week, DuPont announced a new lease with Facebook for 7.43 MW in ACC7 Phase I and II" (4.46 MW at Phase I commences immediately' with balance in Q4 2015 when Phase II comes on-line).

- 2. Yahoo! Inc. (NASDAQ: YHOO) Sub-Lease: Foster is "cautiously optimistic" about releasing the 10.4 MW at ACC II, which expires in September, while noting that it must happen soon in order to avoid "any downtime."

- 3. Net Data Center Bankruptcy: Foster said, "We continue to believe any form of resolution will result in some form of additional revenue and thus at this point be a positive development."

- 4. Strategic Review: While completion is still a few months away, "the goal is to put the company in position to sustain >10 percent top-line growth, which Mr. Foster said today is difficult considering their current four market footprint."

- 5. Key Growth Drivers Include Market Expansion: DuPont is evaluating six, and likely will add two to its existing four markets; Foster expects that DFT will likely utilize an M&A strategy to expand.

Cowen did not update its views on DuPont Fabros in the conference notes.

Image Credit: Public Domain

Latest Ratings for DLR

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Deutsche Bank | Maintains | Hold | |

| Feb 2022 | Wells Fargo | Maintains | Overweight | |

| Feb 2022 | Barclays | Maintains | Equal-Weight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Long Ideas REIT Short Ideas Dividends Analyst Ratings Tech Trading Ideas