Oppenheimer: 25% Upside For Small-Cap REIT Bluerock Residential

Last Friday, Oppenheimer & Co. (Opco) analysts Amit Nihalani and Steve Manaker published a report titled "Attractively Valued Growth Story…" and initiated coverage of $263 million cap Bluerock Residential Growth REIT Inc (NYSE: BRG) at Outperform.

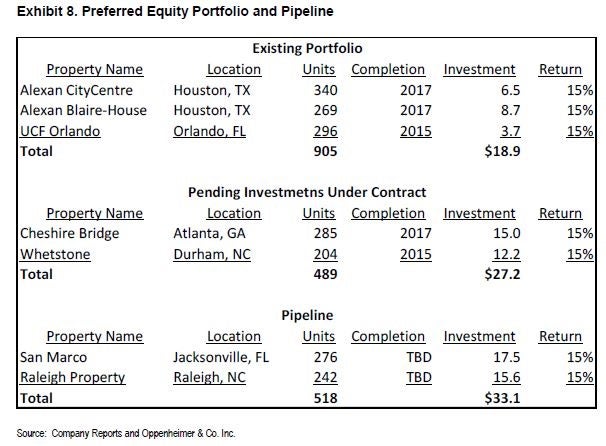

Bluerock provides capital at a target 15 percent preferred return to fund the development of multi-family apartment communities with an option to purchase them at below market valuations.

The Bluerock strategy includes the ongoing sale of stabilized apartment communities, which can make it more difficult to project earnings on a quarterly basis, as opposed to some of its industry peers.

However, according to the company's earnings release, during Q1 2015, Bluerock disposed of its investment in 23Hundred@BerryHill Nashville property for $61.2 million or $230,000 per unit, citing "an IRR of 60 percent, and total return on capital of 282 percent."

Tale Of The Tape: Peers/Big Picture

On May 11, $282 million cap Independence Realty Trust Inc (NYSE: IRT) announced the acquisition of $268 million cap Trade Street Residential Inc (NASDAQ: TSRE) for cash and stock.

On May 26, Bluerock issued approximately 6.35 million common shares in a secondary offering at $13.00 per share, netting Bluerock approximately $77.4 million.

Preferred Apartment Communities Inc. (NYSE: APTS), with a similar market cap of $255 million, has outperformed its peer group during the past year. One unique aspect of Preferred Apartment approach is that its portfolio includes neighborhood shopping centers and student housing along with its apartment assets.

Preferred Apartment also enters into forward purchase agreements for communities under development, where it provides bridge and mezzanine loans in conjunction with its purchase option.

Opco–Bluerock: Initiate Outperform, $16 PT

The Opco $16 target price represents a potential 17.2 percent upside for Bluerock shares, based upon the previous close of $13.65 per share for a total return of 25.7 percent, including the 8.5 percent dividend yield.

Opco based its $16 PT on 13.3x its 2016 estimated AFFO of $1.20 per share. Notably, this AFFO multiple is a 41 percent discount compared to Opco's overall residential REIT sector, which includes many established larger cap names.

Additionally, Opco's FFO estimates are below consensus for both 2015 and 2016, and Bluerock shares are trading at a 14 percent discount to Opco's NAV estimate of $15.90, based on a 5.5 percent cap rate.

However, Bluerock intends to continue operating at higher leverage ratio than its peer group (targeting approximately 65 percent), and utilizes a development model that inherently has more moving parts than simply owning and acquiring portfolios of stabilized communities.

Opco–Bluerock: Investment Thesis

Opco views Bluerock "as a growth REIT, buying assets by investing in complex real estate situations. The REIT typically invests in projects that have capital or operational issues.

Bluerock's investment process identifies properties that have good long-term potential and sees through the near-term issues, which allows Bluerock to purchase attractive assets at below-market rates.

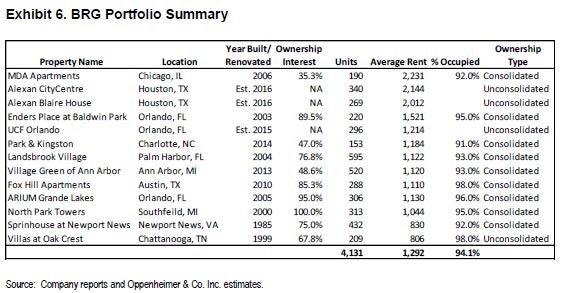

The existing Bluerock portfolio is 94.1 percent occupied and contains 4,131 apartment units (including 636 units of preferred equity) with average rent of $1,292.

Opco–Bluerock: Dividend/Risks

Since its IPO in 2014, Bluerock has paid a monthly dividend of $0.0967 per share, equivalent to $0.29 per quarter, or $1.16 annually.

Opco believes that "the current dividend is safe," but does not anticipate that it will be increased in the near term.

Opco calculates that Bluerock "will pay out 137 percent of our estimated 2015 AFFO, and 96 percent of our 2016 estimates. These numbers assume no dividend growth over the next two years."

Opco–Bluerock: Risk Factors

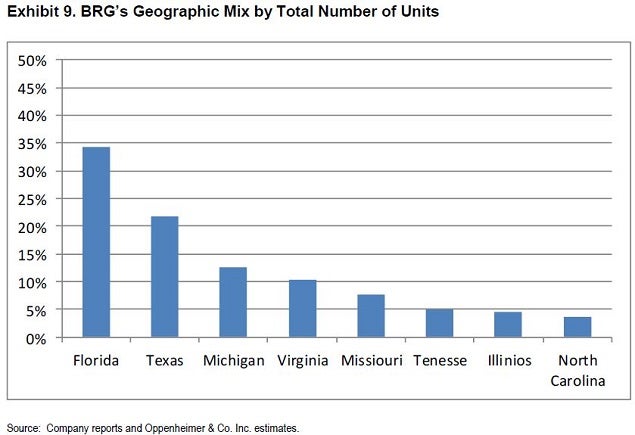

While Bluerock has significant exposure to Central Florida markets, Opco expects "the concentration will decline as the portfolio grows."

Opco also noted broad and local economic slowdowns, increased supply due to new development and rising interest rates as potential risks.

Opco–Bluerock: Big Picture

Opco noted, "We believe the timing is right for BRG's strategy. Non-Gateway markets in the Southeast are experiencing above average job and population growth. The demand for quality apartments is increasing with absorption outpacing new developments. Multifamily fundamentals are strong with occupancy at full capacity and rental rates rising. We expect this trajectory to continue with the US economy steadily improving."

Image Credit: Public Domain

Latest Ratings for BRG

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Dec 2021 | Compass Point | Maintains | Neutral | |

| Dec 2021 | JMP Securities | Downgrades | Market Outperform | Market Perform |

| Apr 2021 | BTIG | Upgrades | Sell | Neutral |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: 23Hundred@BerryHill NashvilleAnalyst Color Long Ideas REIT Dividends Analyst Ratings Trading Ideas Real Estate Best of Benzinga