TD Ameritrade Clients Bought Twitter, LinkedIn; Sold Bank Of America And Citigroup Last Month

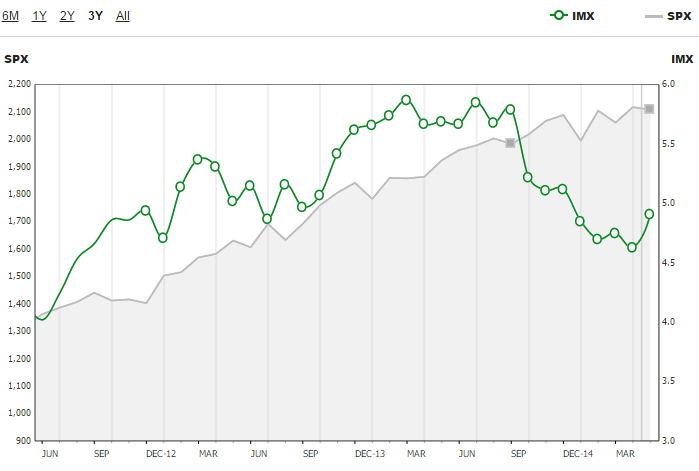

TD Ameritrade Holding Corp. (NYSE: AMTD) operates and tracks a proprietary monthly metric known as the Investor Movement Index (IMX), which monitors the sentiment of retail investors.

The company released on Monday its data set for the month of May in which the index rose higher by 0.28 points (or 6.05 percent) to 4.91.

The data is compiled by analyzing six million investors' positions, trading activity, and other data. A score that increases month over month implies investors are getting more bullish.

"TD Ameritrade clients were net buyers of equities during the May IMX period, which helped drive the IMX to its third largest month-to-month percentage increase since tracking of the index began in December 2012," TD Ameritrade stated in its report.

"Net buying of equities was not the only factor in the increase, however, as some widely held positions saw increases in volatility relative to the overall market, which helped to further the increase in the IMX."

Notable Trading Activities

TD Ameritrade noted that its clients were net buyers of Twitter Inc (NYSE: TWTR) in May as investors "appeared to see opportunity" following its post quarterly results drop. Investors were also buyers of LinkedIn Corp (NYSE: LNKD), as they were attracted to the name following a steep decline.

TD Ameritrade's clients were also observed to be buying the dip in shares of Starbucks Corporation (NASDAQ: SBUX), Apple Inc. (NASDAQ: AAPL) and Walt Disney Co (NYSE: DIS), all of which traded downward after setting new highs around their earnings announcements.

On the flip side, TD Ameritrade's customers were net sellers of financial names including Bank of America Corp (NYSE: BAC) and Citigroup Inc (NYSE: C), as well as dividend players Microsoft Corporation (NASDAQ: MSFT) and General Electric Company (NYSE: GE).

Latest Ratings for AAPL

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Barclays | Maintains | Equal-Weight | |

| Feb 2022 | Tigress Financial | Maintains | Strong Buy | |

| Jan 2022 | Credit Suisse | Maintains | Neutral |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: dividend stocks financial stocks Investor Movement Index social media stocksAnalyst Color News Top Stories Analyst Ratings Best of Benzinga