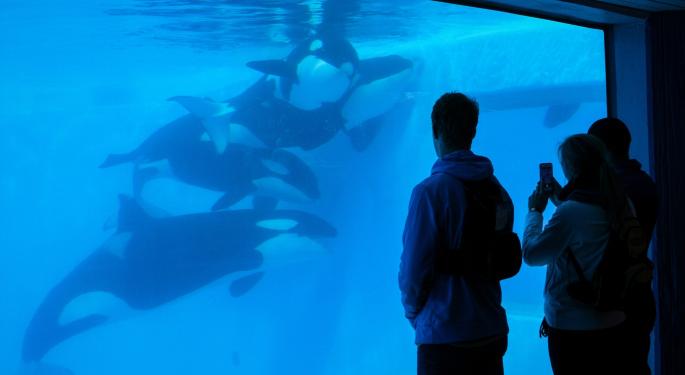

SeaWorld Set For A Turnaround?

In a report issued Wednesday, Credit Suisse analysts Joel Simkins, Benjamin Chaiken and Christie Fredericks reiterated an Outperform rating and $27.00 price target on shares of SeaWorld Entertainment Inc (NYSE: SEAS). They believe that, while brand sentiment may be bottoming, brand repositioning efforts could create a good long-term opportunity.

Following a long period of negative publicity driven by Blackfish (and a sluggish response from the former management team), the firm thinks brand sentiment is finally bottoming. In fact, a survey conducted by Credit Suisse suggests that while still negative, online consumer sentiment seems to be stabilizing.

If the company can begin to generate “a positive consumer buzz and convey to customers that it's ‘okay’ to visit SeaWorld, this should translate into pricing, attendance, and margin growth,” the experts say.

While reverting the negative sentiment is a “multi-step operation,” the analysts opine that should SeaWorld “continue articulating a plan to reposition their brand, investors will be able to gain more comfort on the viability of the business long-term.”

So, to move past Blackfish, the company is now promoting other aspect of their parks, and has recently announced the opening of several thrill rides through 2017. According to the research note, this “will help to diversify the SeaWorld experience and create more options for those who are disinterested in attending the parks purely for their wildlife entertainment.”

Latest Ratings for SEAS

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Deutsche Bank | Maintains | Buy | |

| Nov 2021 | Deutsche Bank | Initiates Coverage On | Buy | |

| Nov 2021 | Citigroup | Maintains | Neutral |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Benjamin Chaiken BlackfishAnalyst Color Long Ideas Price Target Reiteration Analyst Ratings Trading Ideas Best of Benzinga