Do Women Have More Purchasing Power Than Men?

In a recent report from Needham & Company, analysts Laura Martin and Dan Medina discuss the implications of the continued growth in women’s earning and purchasing power in the United States.

Earning Vs. Spending

Despite lower average earnings, women in the U.S. account for the vast majority of U.S. consumer spending. In 2013, women were responsible for 80 percent of consumer spending in the U.S. while taking home only 42 percent of the total wages earned that year. These numbers indicate that women spent more than twice as much relative to their earnings compared to men.

Related Link: 10 Women In Finance To Follow On Twitter

Closing The Salary Gap

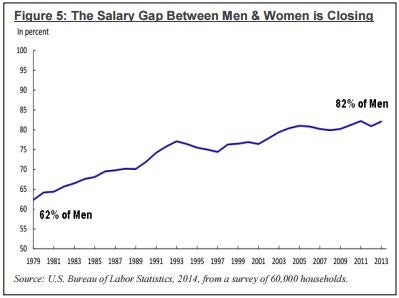

As women’s earnings growth continues to outpace men’s, the economic influence of women in the U.S. could expand even further. Between 1979 and 2013, women’s earnings have grown from 62 percent of men’s median weekly wages to 82 percent, with women in 2013 earning $706 per week on average as compared to men’s average $860 per week.

For women aged 35 to 64, the salary gap is even narrower, with women in this age group earning $770 per week on average.

What Women Are Buying

The Needham report reveals online shopping has allowed women to spend 25 percent more money than they did in 2002 in 14 percent less time, which is good news for online businesses such as Bankrate Inc (NYSE: RATE) and TripAdvisor Inc (NASDAQ: TRIP).

Since women also spend more time, on average, on social media sites and mobile devices, companies such as Pandora Media Inc (NYSE: P) and Facebook Inc (NASDAQ: FB), which derive most of its revenue from mobile users, should benefit from the growing purchasing power of women.

Additionally, companies such as Neilson NV (NYSE: NLSN), comScore Inc (NASDAQ: SCOR), and Rentrak Corporation (NASDAQ: RENT), which measure audiences and target consumers, should help advertisers in reaching out to women shoppers.

Latest Ratings for RATE

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2017 | Oppenheimer | Initiates Coverage On | Outperform | |

| Nov 2016 | Loop Capital | Upgrades | Hold | Buy |

| Aug 2016 | Loop Capital | Initiates Coverage On | Hold |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Dan Medina Laura Martin NeedhamAnalyst Color Top Stories Economics Analyst Ratings Best of Benzinga