CyrusOne Is Soaring After Earnings, Here's Why

Data center REITs provide a home for cloud computing, wireless data, media content, financial records and many other critical enterprise applications.

On August 5, data center REIT CyrusOne Inc (NASDAQ: CONE) CEO Gary Wojtaszek hosted the company's earnings call for the quarter ended June 30, 2015.

While CyrusOne was the last data center REIT to report, investors felt the results were well worth the wait. CyrusOne shares have made several new highs the week immediately following earnings and new guidance for FY 2015.

A Series Of All-Time Highs After 2Q15 Earnings Call

During the past 52 weeks, CyrusOne had traded in a range of $22.94–$34.50 per share.

CyrusOne shares closed at yet another all-time high last Friday, settling at $34.61 after hitting $34.75 during intraday trading.

Cervalis Acquisition

Mr. Market and Wall Street analysts have had more time to digest CyrusOne's $400 million acquisition of Cervalis, which closed on July 1, 2015.

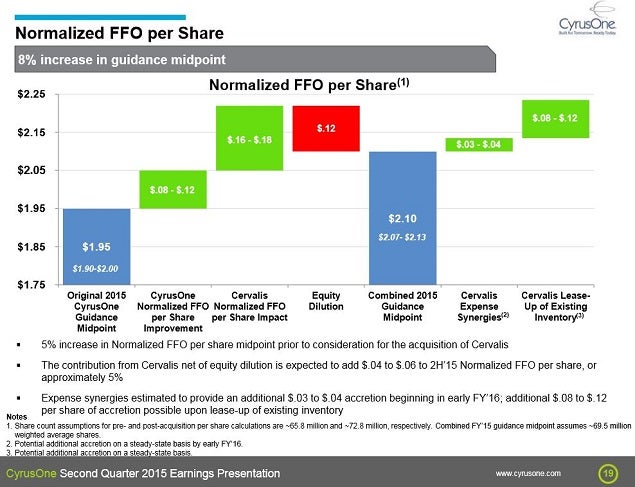

Along with Q2 results, CyrusOne raised its FY2015 FFO mid-range guidance 8 percent from $1.95 to $2.10 per share, including an estimated 5 percent from Cervalis contribution for 2H15.

Moving forward, CFO Kim Sheehy anticipates additional expense synergies and revenue contribution from the leasing of vacant space in Cervalis facilities, as shown above.

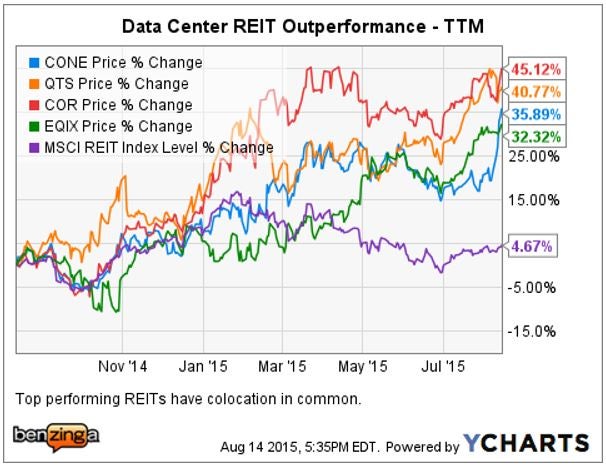

Colocation Drives Sector Outperformance

Along with CyrusOne, data center REIT peers CorSite Realty Corp (NYSE: COR) and QTS Realty Trust Inc (NYSE: QTS) have been top performers during the past 12 months, along with global interconnection leader Equinix Inc (NASDAQ: EQIX).

Data center REITs focused upon colocation, interconnection and cloud services such as IaaS (infrastructure as a solution) have outperformed sector rivals that have traditionally focused on leasing large powered shells with dedicated infrastructure.

Competition Is Heating Up

Shares of wholesale giant Digital Realty Trust, Inc. (NYSE: DLR) have lagged its more network dense peers, up only 1.5 percent during the same period.

However, Digital's recent decision to acquire colocation rival Telx for $2.9 billion could be a game-changer moving forward.

CyrusOne: 2Q15 Earnings Highlights

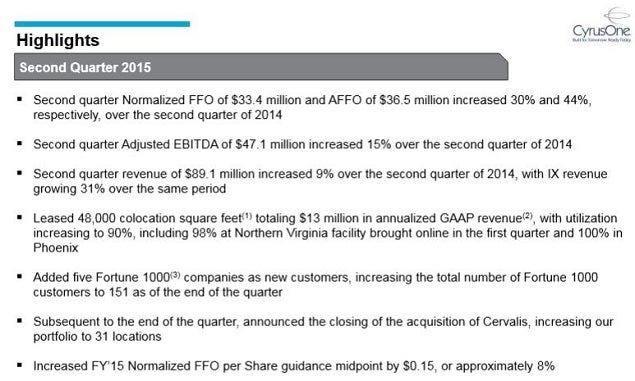

Wojtaszek reminded listeners on the call that CyrusOne has executed on its strategy announced last year to "pull back on capital investment and increase asset utilization."

During the past 12 months, CyrusOne has added 160,000 square feet of raised floor, while increasing utilization by 400 basis points to a high of 90 percent.

CyrusOne: 2Q15 Earnings Call Presentation Highlights

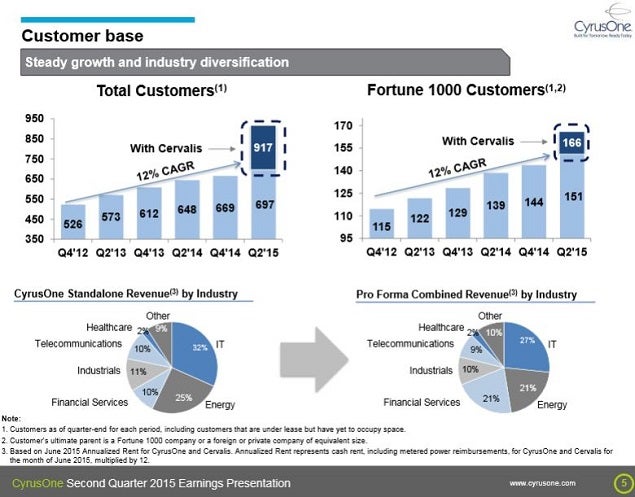

During the quarter, CyrusOne added 18 new logos, including five Fortune 1000 companies, taking its customer count up to 697 and including 151 Fortune 1000 firms.

Cervalis adds another 220 customers to the CyrusOne roster, including an additional 15 Fortune 1000 names. Cervalis NY/NJ's focus more than doubled the CyrusOne financial services vertical market, while also reducing CyrusOne's energy segment concentration.

Historically, 50 percent of growth each quarter comes from CyrusOne's existing customer base.

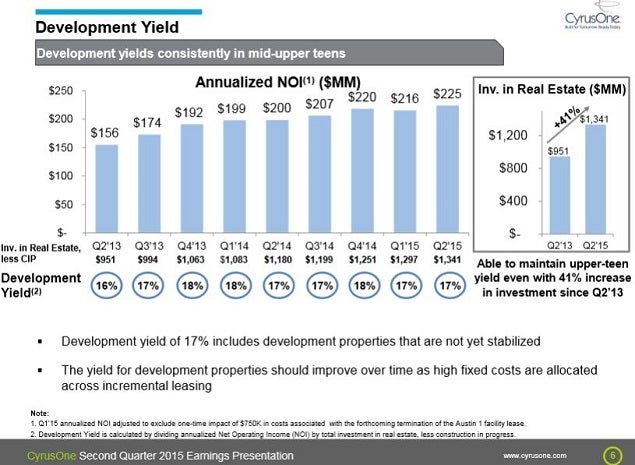

New Development Pays Big Dividends

CyrusOne's industry leading development yields have consistently been in the high-teens, including its non-stabilized development properties.

This compares favorably with Digital Realty's targeted 10 to 12 percent unleveraged yields and QTS Realty's 15.2 percent ROIC on stabilized assets.

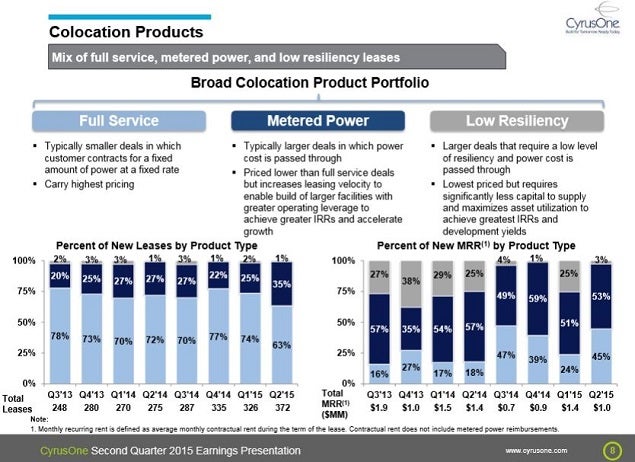

Flexible Colocation Products

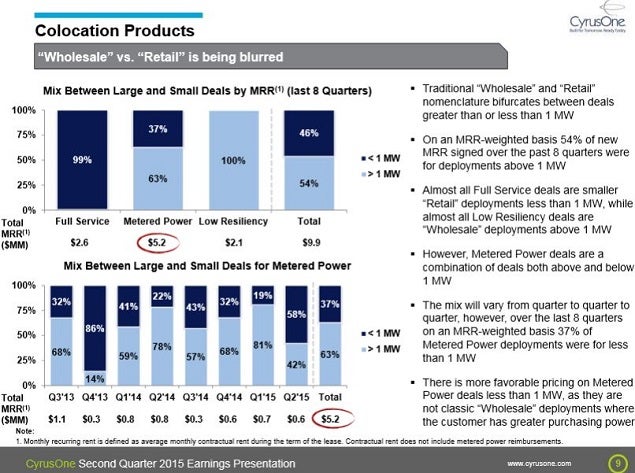

Wojtaszek explained, "The mix of products, both by resiliency and size, is what enables us to continue to achieve the mid-to-upper-teen development yields."

Notably, leases signed during the last four quarters were for much longer durations (averaged 6.5 years) and contained rent increases averaging 2.6 percent.

Customers Just Want Solutions

The shared infrastructure model gives CyrusOne the flexibility to take the $7 million/MW development cost and offer different products. "So we can be really kind of price discriminatory, and kind of serve up exactly what a customer wants and charge on a blended price, that's higher than if we were to sell that same megawatt on a dedicated basis," according to Wojtaszek.

CyrusOne's two-year-old interconnection business segment revenue was up by 31 percent Y/Y and 4 percent sequentially. However, this fast growing business, which utilizes an "outsourced network model," still only accounted for 5 percent of CyrusOne's 2Q15 revenue.

Additionally, Cervalis has a managed service product, which currently accounts for only 3 percent of the combined company revenues.

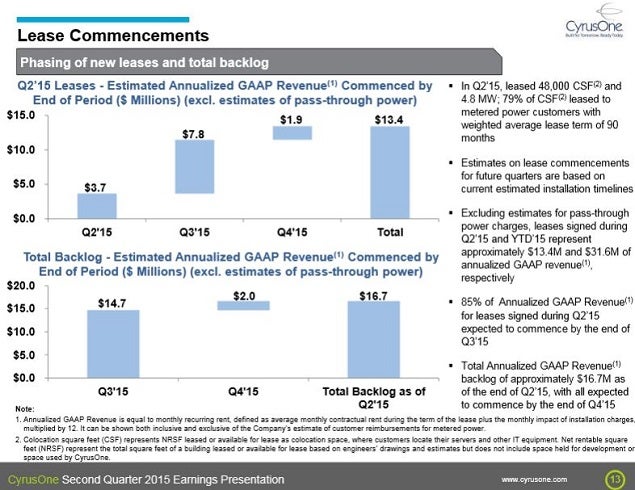

Q2 Leasing Generates 2H15 Revenues

CFO Kim Sheehy stated, "As of the end of the quarter, our total backlog of annualized GAAP revenues stood at $16.7 million. We estimate that by the end of the fourth quarter, we will have commenced all leases currently in the backlog."

By way of comparison, QTS Realty's booked-not-billed currently stands at $69 million, with the majority expected to commence during FY 2016 and FY 2017.

Looking Forward

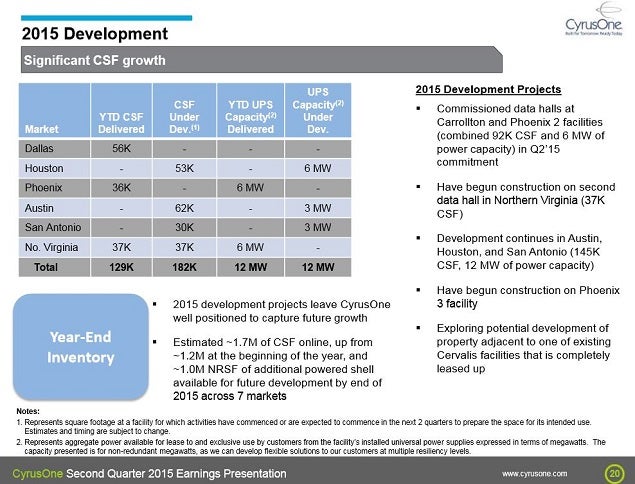

"By the end of the year, including Cervalis locations, we expect to have a total of approximately 1.7 million square feet of raised floor online, up from approximately 1.2 million square feet at the beginning of the year with another 1 million square feet of powered shell available for future development across seven markets," Sheehy explained.

Investor Takeaway

Wojtaszek pointed out that CyrusOne's competitors also reported strong quarters "driven by increased data demand and secular outsourcing trends, which we still believe is in its early stages."

CyrusOne is, at the time of this writing, trading up around 2.25 percent at $35.40.

Latest Ratings for CONE

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | TD Securities | Downgrades | Hold | Tender |

| Nov 2021 | Jefferies | Downgrades | Buy | Hold |

| Nov 2021 | Credit Suisse | Maintains | Neutral |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Long Ideas REIT Top Stories Analyst Ratings Tech Trading Ideas General Best of Benzinga