UBS Notes Significant M&A Activity, Spotlights Latest Industrial REIT Pick

On Tuesday, UBS Global Research analysts Jeremy Metz and Russ Nussbaum published research notes focused on the bevy of recent activity in U.S. institutional quality industrial and warehouse properties so far this year.

According to Metz, "2015 continues to be marked by M&A with close to $8 billion announced in the last 30-days alone at sub-6 percent cap rates, highlighting the robust demand/pricing for institutional grade industrial CRE in the U.S."

He noted that strong fundamentals, such as higher rent and occupancy levels, combined with new development at "rational" levels are helping to fuel demand for this asset class.

M&A Big Picture: 2015 YTD

UBS reported that rumors surfaced last week that sovereign wealth fund ADIA and PSP were in negotiations to buy a 55 million square foot portfolio of assets from Exeter Property Group for $3.25 billion.

Source: Exeter Property Group

This acquisition would be at an approximated 5.9 percent cap rate according to sources named in the report. Metz believes that an outright sale at that cap rate might preclude a rumored Exeter IPO.

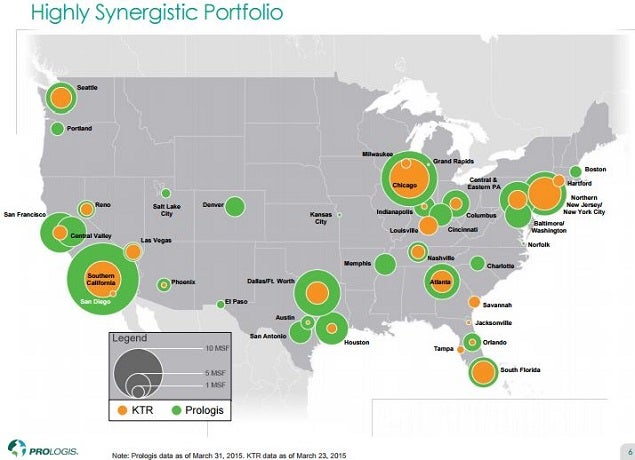

Larger industrial M&A deals so far this year mentioned in the report included Prologis Inc (NYSE: PLD)'s $5.9 billion acquisition of the KTR industrial portfolio at a 5.4 percent cap rate.

Prologis acquired the portfolio through a 55/45 joint venture with Norges Bank Investment Management (NBIM) in the Prologis U.S. Logistics Venture.

Source: Prologis - April 2015

The same $890 billion Norwegian sovereign wealth fund had previously invested in a Prologis European industrial portfolio back in 2012.

In February 2015, Blackstone Group LP (NYSE: BX) closed the sale of its IndCor U.S. industrial real estate platform to GIC for $8 billion, which represented a 5.8 percent cap rate.

Blackstone had already filed for an IndCor IPO in September 2014, but chose an outright sale to realize the imbedded gains in the industrial portfolio assembled from 2010 to 2014.

UBS Industrial REIT Picks

In the industrial REIT space, UBS maintains a Buy rating on global logistics giant Prologis, while Nussbaum upgraded the second largest U.S. industrial REIT $7 billion cap Duke Realty Corp (NYSE: DRE) from Neutral to Buy in a separate Tuesday morning note.

Nussbaum mentioned DCT Industrial Trust Inc (NYSE: DCT) as another name that UBS likes as a U.S. industrial pure-play, but he chose to maintain his Neutral rating.

UBS–Duke Realty: Upgraded Neutral To Buy, PT Raised From $21 To $23

The new UBS target price of $23 is in-line with the UBS forward NAV estimate of $22.52 per share.

UBS utilized a lowered 5.85 percent blended cap rate (previously 6 percent), which reflected recent public and private transactions across industrial, medical office building and office asset classes.

UBS Rationale

While Duke Realty is the second largest U.S. industrial REIT, it has actively been pruning non-core office assets from its portfolio.

Nussbaum noted there had been "over $3 billion of asset sales since the start of 2013 including ~$1.4 billion in 2Q15, DRE continues to actively reposition the portfolio away from non-core suburban office/light industrial and into bulk industrial."

He expects that for FY2016, Duke will have reduced the NOI from these assets from approximately 11 percent to approximately 5 percent, and pointed out that the medical office building assets are well located.

Duke's $550 million development pipeline is 45 percent pre-leased at approximately 7.1 percent cap rates and should be fully funded from recycled capital.

Investor Takeaway

While some major players are choosing to realize gains on high quality U.S. industrial assets to take advantage of cap rates below 6 percent, it appears that buyers are looking at the strong fundamentals, synergies from scale in existing markets and the long-term value proposition.

Image Credit: Public Domain

Latest Ratings for DRE

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | Truist Securities | Downgrades | Buy | Hold |

| Jan 2022 | Raymond James | Maintains | Outperform | |

| Jan 2022 | BMO Capital | Downgrades | Outperform | Market Perform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Long Ideas M&A REIT Dividends Top Stories Analyst Ratings Trading Ideas Best of Benzinga