Telecom High-Yield Bonds Saw Huge Selloff In September, Surpassing Energy, Metals And Mining

Over September, the Bank of America Merrill Lynch U.S. High-Yield Index lost 2.59 percent, marking its worst month since June of 2013. Over the entire third quarter, the index was down 4.9 percent. In fact, the high-yield market retrieved negative over the whole year, although August was essentially flat at 0.07 percent. The total loss currently amounts to at 2.53 percent.

Marty Fridson, Chief Investment Officer of Lehmann Livian Fridson Advisors, elaborated that the index’s option-adjusted spread (OAS) surged in September from 570 bps to 662 bps.

“That widening of the credit spread probably reflected to a considerable extent the widespread fears of illiquidity in the event of a rise in interest rates. A resulting flight to quality drove down Treasury yields (…) Treasury returns increased as maturity lengthened, except that the ten-year return exceeded the 30-year return. Evidently, investors did not view maximum-duration Treasuries as the safest of all possible havens,” the note expounded.

“In high-yield, the relationship between return and maturity was the opposite of the pattern in Treasuries. The longer the paper, the lower was the return, with the longest maturities (15-plus years) winding up out of line. Underlying those figures, OAS increased the most (119 bps) in the shortest maturity bucket and the least (46 bps) in the longest maturity bucket, but as a matter of basic bond math the impact of a one basis point rise in yield increased as maturity lengthened.”

A Sectorial Look

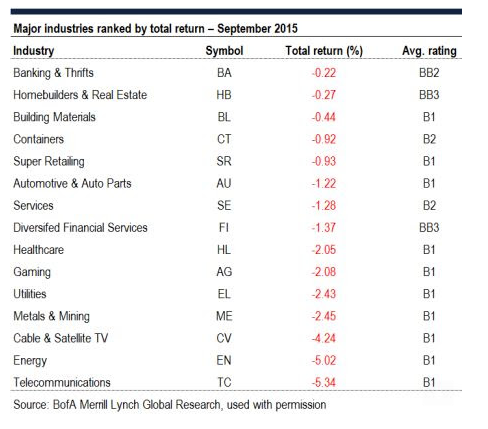

Looking at the return ranking of major industries (see table below), one thing comes to light: August’s two worst performers, energy and metals/mining, improved slightly, but remained close to the lower end of the ranking. Conversely, telecom bonds fell substantially and were the worst performers last month.

Source: LCDcomps.com; S&P

The most dramatic event in the telecom industry was “a plunge in Sprint bonds following a Moody’s downgrade from B2 to Caa1,” Fridson assured. “That large issuer’s decline did not distort the overall performance of the telecom sector, however. Bonds of seven other Telecom issuers posted total returns of -5 percent or lower in September, with the Wireline, Wireless, and Satellite subindustries all represented among those severely underperforming companies.”

Despite this, the telecom sector remains on its fair value line, the analyst added, “with its cheapness versus its ratings justified by the worst ratings prospects in the peer group.”

Disclosure: Javier Hasse holds no positions in any of the securities mentioned above.

Image Credit: Public Domain

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Lehmann Livian Fridson Advisors Marty FridsonAnalyst Color Bonds Top Stories Markets Analyst Ratings Movers Best of Benzinga