Here's What Wall Street Thinks Of Chimerix After The Crash

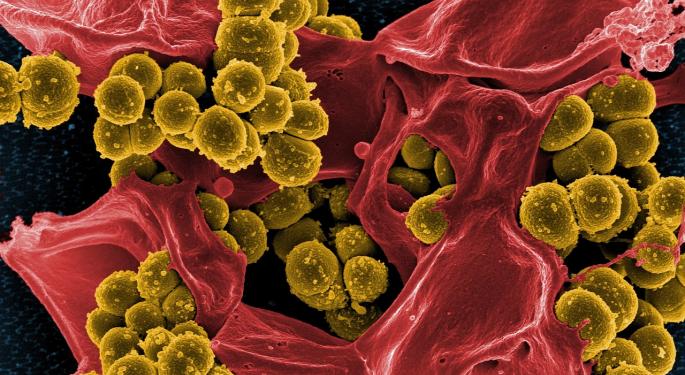

Chimerix Inc (NASDAQ: CMRX) shares were crushed on Monday, as the stock fell more than 80 percent following news that its brincidofovir SUPPRESS study fell short of endpoint expectations in the prevention of cytomegalovirus (CMV) infection.

After the big fall, is it time to stick a fork in Chimerix, or has the panic selloff created a value opportunity? Here’s what three top Wall Street firms have to say about Chimerix now.

Barclays

Analyst Geoff Meacham believes it’s “premature to write off brincidofovir just yet,” but the firm reduced its price target from $65 to $12 following the news.

Meacham will be looking for data on the adenovirus (AdV) approvability based on the AdVise study outcome and resumption of the solid organ transplant studies (SOT) within the next six months. The firm maintains an Outperform rating on the stock.

FBR & Co

Analyst Ed White pointed out that Chimerix has capital levels “sufficient to bring additional product candidates into development and chart a way forward for the company,” but FBR has lowered brincidofovir’s probability of approval to only 10 percent. The firm has downgraded the stock to Market Perform and reduced its price target to $14.

JPMorgan

JPMorgan sees “a number of significant overhangs that the company will need to address to restore investor confidence” and has downgraded the stock to Neutral following the disappointing news. The firm noted there are few near-term events that could reverse negative market sentiment. JPMorgan now has a $15 price target on Chimerix.

Disclosure: The author holds no position in the stocks mentioned.

Think we missed something? Need more coverage? Submit news tips to tip@benzinga.com and we'll be sure to look into it.

Image Credit: Public Domain

Latest Ratings for CMRX

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Dec 2021 | HC Wainwright & Co. | Maintains | Buy | |

| Nov 2021 | HC Wainwright & Co. | Maintains | Buy | |

| Jun 2021 | HC Wainwright & Co. | Maintains | Buy |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Biotech Long Ideas Downgrades Price Target Reiteration Top Stories Analyst Ratings Best of Benzinga