Is Tesla Worth $50 Per Share, $413 Or Somewhere In Between? This Analyst's Valuation Range Is Enormous

Tesla Motors Inc (NASDAQ: TSLA)'s meteoric rise in the U.S. equity markets is on hold, at least for the moment. Shares are down 21 percent in the past month, as concerns over lower Model 3 volume and a slowing economy circulate.

On Monday, Tesla perma-bull Adam Jonas of Morgan Stanley lowered his price target on the tech company significantly, but still sees potential upside to $333 per share. The stock is currently near $194 level late Monday morning.

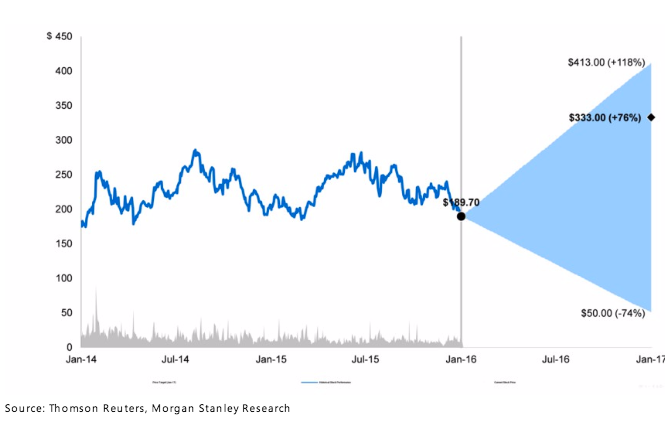

Worth noting, Jonas sees an extremely wide range of potential valuations for Tesla. From $50 to $413 to be exact:

$333: The Price Target

Jonas' price target-related thesis says there's uncertainty over how much the market will adopt a Tesla on-demand mobility service. While Model S reception has been "very positive," Model X expectations may be too high. Most likely, the car will be "nice," Jonas wrote, but "a bit rarer" than some bulls first thought.

In this scenario, low energy prices make Tesla's battery division worth less than initial valuations.

Related Link: Tesla's Weekend Model X Event 'Hugely Successful,' Analyst Says

$413: The Bull Case

Jonas' bull case, meanwhile, values Tesla Mobility at $129 per share alone. The company's core business is worth another $234 in this scenario, and Tesla Energy is worth $49. The company's mobility efforts account for the greatest increase in value here.

$50: The Bear Case

Perhaps most interestingly, Jonas sees $50 for Tesla in an absolute worst case scenario. Here, Tesla Energy and Tesla Mobility don't account for any per share value. The company's core business would face this discount if it were "limited to niche premium brand status," Jonas said, adding that it'd be a "thriving, but small company with OP margins normalizing at <10%."

Other issues hypothetically plaguing Tesla in the $50 scenario include: Model X execution problems, Model X and S volume of just 70,000 by 2020 and Gen 3 volume of just 60,000 by the same year.

That total -- 130,000 -- would be significantly below a rumored 500,000 unit goal by 2020.

Latest Ratings for TSLA

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Daiwa Capital | Upgrades | Neutral | Outperform |

| Feb 2022 | Piper Sandler | Maintains | Overweight | |

| Jan 2022 | Credit Suisse | Upgrades | Neutral | Outperform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Long Ideas News Price Target Analyst Ratings Movers Tech Trading Ideas