StockTwits Data Paints Bleak Picture For GoPro

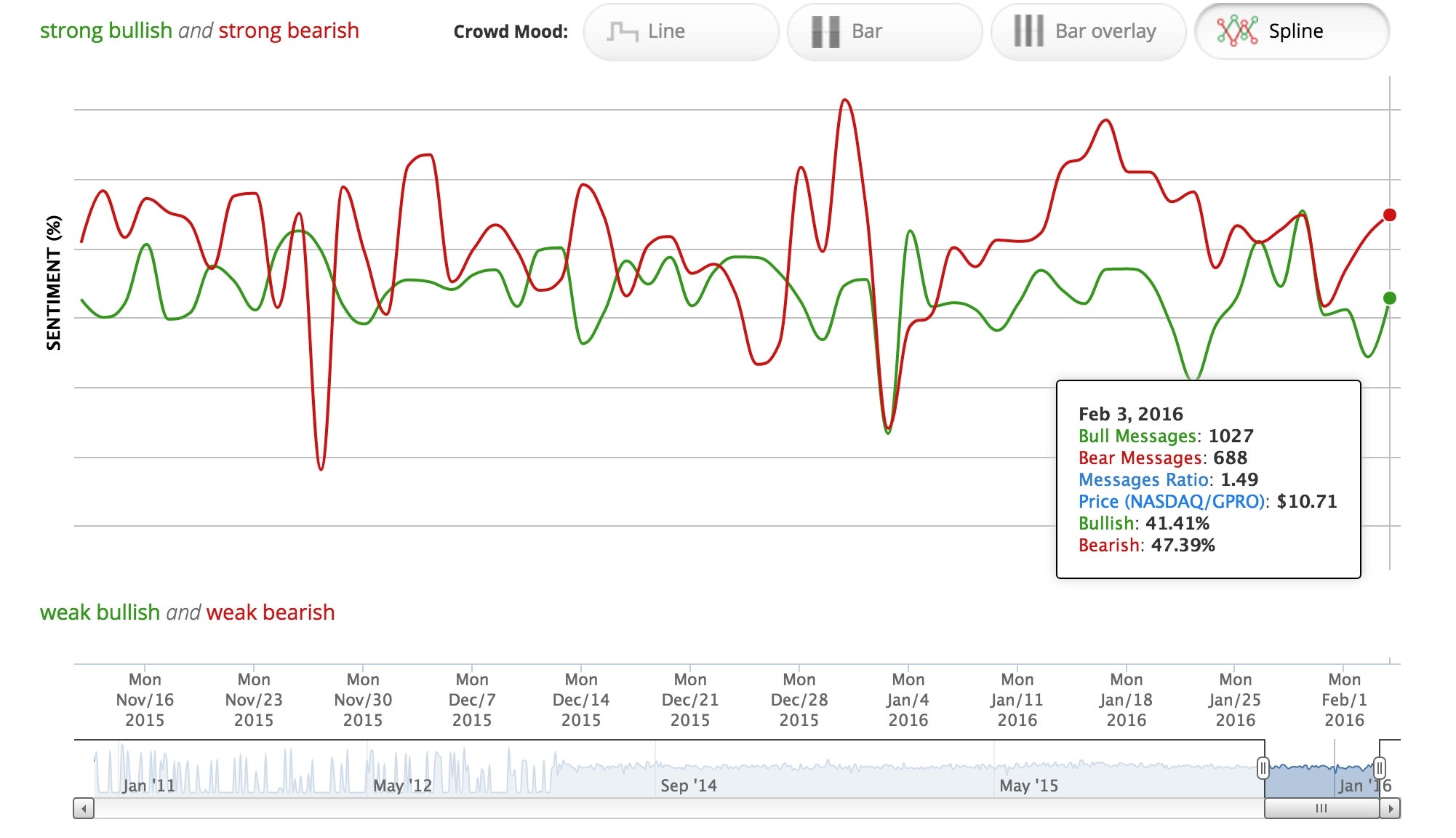

Typically, a stock that has declined as much as GoPro Inc (NASDAQ: GPRO)’s stock has will inspire a swing in value-driven or contrarian bullish sentiment in the market. However, as GoPro’s stock dips into the single digits, down more than 80 percent in the past year, the latest data from StockTwits shows that there is little evidence of a contrarian bounce in the near future.

Recent bearish sentiment in GoPro on StockTwits peaked on January 15 when 54 percent of messages were bearish. Following the bearish sentiment peak, the share price continued to fall another 13.3 percent in recent weeks. To make matters worse, StockTwits has recorded yet another pickup in bearish sentiment already in early February.

Related Link: 2 Ex GoPro Inc Bulls Downgrade Stock: Now A Broken Stock And A Broken Company?

One thing is for certain: it seems like Wall Street’s sentiment for GoPro could not get much worse.

GoPro was one of many stocks, including Twitter Inc (NYSE: TWTR), Fitbit Inc (NASDAQ: FIT), Groupon Inc (NASDAQ: GRPN) and Zynga Inc (NASDAQ: ZYNG) that Global Equities Research analyst Trip Chowdhry calls “total garbage” in terms of long-term value for investors.

Even former GoPro bulls Dougherty & Co and Sterne Agee CRT finally threw in the towel this week and downgraded the stock to Neutral.

Disclosure: the author holds no position in the stocks mentioned.

Latest Ratings for GPRO

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Jefferies | Initiates Coverage On | Buy | |

| Dec 2021 | Wedbush | Upgrades | Neutral | Outperform |

| Nov 2021 | JP Morgan | Upgrades | Neutral | Overweight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: stocktwitsAnalyst Color Education Analyst Ratings Tech General Best of Benzinga