SunTrust Sets Neutral Rating, $39 Target On Kroger

SunTrust Robinson Humphrey has started coverage of The Kroger Co (NYSE: KR) with a Neutral rating and $39 price target, which implies an upside of 10.9 percent.

Though the nation's largest conventional supermarket chain has managed to beat Street EPS estimates in six out of the past eight quarters, analyst David Magee said the most recent quarter showed a "chink in the armor," as the company reported its first "operating" earnings miss in over four years.

"While the reasons for the miss were partially temporal (difficult weather comparisons; timing shift), we believe the hill has gotten steeper with regard to upside," Magee wrote in a note.

Magee said the company's operational drivers, including price investments, store upgrades, and private label, natural/organic SKU additions, are in the later stages of execution and may not have the same incremental effect going forward.

"The newer initiatives (ClickList, home delivery, new store concepts) are too embryonic to provide a similar tailwind in the near term," Magee noted.

As a result, Kroger is poised to migrate back to high single-digit bottom-line growth, low single digit comp and square footage growth. Magee sees FY16 and FY17 EPS at $2.25 and $2.45, respectively.

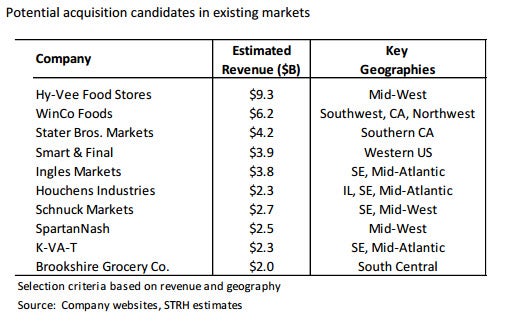

The analyst said the upside has to come primarily from the acquisitions. The analyst has identified up to 20 potential acquisition candidates and believes it makes sense for Kroger to target one roughly every two years. These include potential "white space" acquisition candidates, or those that would immediately broaden KR's geographic reach overnight.

"Our resulting $39 price target, which assumes that the "out-year" multiple expands one point to 16x, doesn't represent a sufficient enough gain for a Buy rating. Instead, we rate KR as Neutral," Magee added.

Shares of Kroger closed Tuesday's session at $35.20, down 0.65 percent.

Latest Ratings for KR

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Deutsche Bank | Maintains | Hold | |

| Mar 2022 | Telsey Advisory Group | Maintains | Outperform | |

| Mar 2022 | BMO Capital | Maintains | Market Perform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: David Magee SunTrustAnalyst Color Price Target Initiation Analyst Ratings