Morgan Stanley Recaps Houston E&P Conference With 5 Takeaways On Oil Drillers

Morgan Stanley hosted an oil services conference in Houston last week where global E&P names gathered to discuss the current environment in the oil complex. Following a volatile start to 2016, which has seen WTI futures close as low as $26.19 and as high as $46.03, here are 5 key takeaways from Morgan Stanley's conference.

- E&P names are slowly returning operations back to capacity in an effort to preserve efficiencies.

- Onshore rig replacements set to begin new cycle. Morgan Stanley says roughly 150 optimized rigs remain in the United States, while international fleets are "highly outdated." Potential plays for future rig automation catalysts are Schlumberger limited. (NYSE: SLB), National-Oilwell Varco, Inc. (NYSE: NOV), Nabors Industries Ltd. (NYSE: NBR) and Independence Contract Drilling Inc (NYSE: ICD).

- 66 percent of drillers reportedly experienced a more resilient Jackup market. Morgan Stanley prefers Rowan Companies PLC (NYSE: RDC) and ENSCO PLC (NYSE: ESV) to play Jackup exposure over 4g/5G floaters.

- As operating expense budgets begin restoration and expansion, Morgan Stanley favors FMC Technologies, Inc. (NYSE: FTI) and Helix Energy Solutions Group Inc (NYSE: HLX).

- Enhanced Oil Recovery (EOR) technique remains in infancy, according to E&Ps presenting at the Houston conference. Completion optimization have been reported to be "in the 3rd or 5th inning" when it comes to improving upon current drilling speeds and technologies.

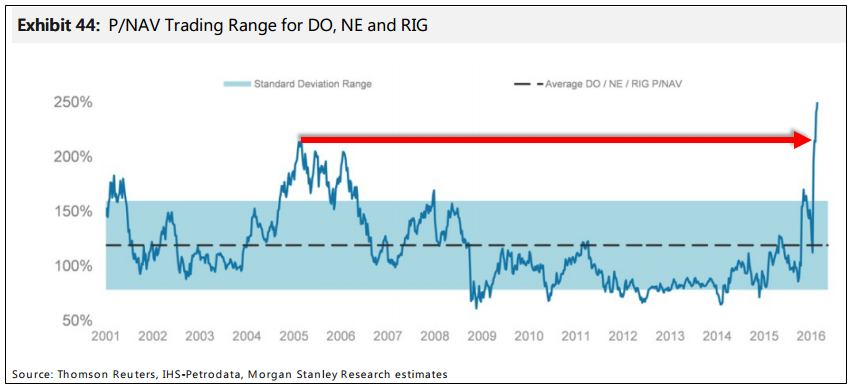

Diamond Offshore Drilling Inc (NYSE: DO), Transocean LTD (NYSE: RIG) and Noble Corporation Ordinary Shares (UK) (NYSE: NE) have seen an combined price to net asset value ratio exploded well beyond 2005 highs:

Just over 90 minutes into Monday's regular trading session, NYMEX Light Sweet Crude oil was up just over 3 percent to $47.60.

Latest Ratings for DO

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Apr 2020 | RBC Capital | Downgrades | Sector Perform | Underperform |

| Mar 2020 | Citigroup | Maintains | Sell | |

| Mar 2020 | Barclays | Downgrades | Overweight | Equal-Weight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: crudeAnalyst Color News Commodities Events Markets Analyst Ratings Trading Ideas Best of Benzinga