Is Brazil's Investment Climate Improving? BRF SA Stands To Benefit

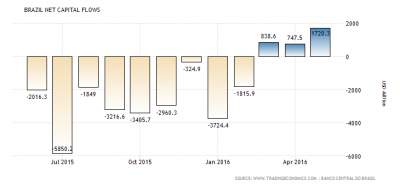

Contrary to public belief, Brazil's investment climate may be improving. According to Trading Economics, Brazil recorded a capital and financial account surplus of USD$1720.30 million in May of this year.

While Brazil's economy underwent a great recession last year, that resulted in a consumer spending contraction and a 30 percent rapid decline of the Brazilian real; this indication could be a key factor in Brazil's recovery.

BRF SA (ADR) (NYSE: BRFS) stands to benefit from an economic recovery in Brazil. The company is the country's largest food processor and largest poultry exporter in the world. BRF SA generates more than half its revenue from its domestic market — meaning the real's decline impacted its earnings severely.

It is, however, making headway to diversify its business globally, according to Seeking Alpha. In 2015, the company spent $496 million to buy assets in Thailand, Argentina and the U.K. BRF SA expected to grow annual revenue overseas by $600 million. To improve margins, the price of products was increased 7 percent in May.

With the new global strategy, strong cash reserves and improving margins, earnings are anticipated to be significantly higher this quarter.

BRF SA announces earnings on July 28.

At time of writing, ADRs of BRF SA were down 0.58 percent on the day, trading at $15.48.

Did you like this article? Could it have been improved? Please email feedback@benzinga.com with the story link to let us know!

Latest Ratings for BRFS

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jun 2021 | Goldman Sachs | Downgrades | Buy | Neutral |

| May 2021 | Barclays | Downgrades | Equal-Weight | Underweight |

| Mar 2020 | Barclays | Maintains | Overweight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Long Ideas Emerging Markets Commodities Markets Analyst Ratings Media Trading Ideas Best of Benzinga