Traders Talking Bazaarvoice Takeout; Potential Suitors Decline To Comment

Shares of Bazaarvoice Inc (NASDAQ: BV), a relatively unknown small-cap company that connects hundreds of millions of shoppers around the world, saw unusual strength on Friday.

Bazaarvoice's Software as a Service (SaaS) solution enables companies to leverage the voice of its customers by creating online social communities that encourages authentic conversations about a brand.

By Friday afternoon, the stock was higher by more than 1.50 percent while the Nasdaq index was lower by 0.21 percent, and the Dow Jones Industrial Average shed 0.38 percent.

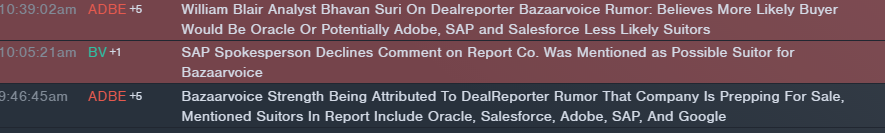

The move was attributed to a DealReporter rumor that the company is preparing itself for a sale and several suitors could be interested. The list of potential suitors consist of Oracle Corporation (NYSE: ORCL), salesforce.com, inc. (NYSE: CRM), Adobe Systems Incorporated (NASDAQ: ADBE), SAP SE (ADR) (NYSE: SAP) and Alphabet Inc (NASDAQ: GOOG) (NASDAQ: GOOGL).

Suitors Decline Comment; Analyst Reaction

As is typically the case, companies tend to have a policy of not commenting on rumors, especially those involving M&A activity.

Benzinga reached out to Bhavan Suri, an analyst with William Blair to discuss a potential Bazaarvoice acquisition.

According to Suri, Oracle is a "more likely buyer" as SAP has not been very acquisitive in the marketing and recommendation space. Adobe "could also be" a potential buyer and Salesforce would likely stay out of the bidding process as it needs time to "digest and integrate" Demandware which it acquired earlier in the summer.

At time of writing, Bazaarvoice was up 2.15 percent on the day, trading at $4.99.

Full ratings data available on Benzinga Pro.

Do you have ideas for articles/interviews you'd like to see more of on Benzinga? Please email feedback@benzinga.com with your best article ideas. One person will be randomly selected to win a $20 Amazon gift card!

Latest Ratings for BV

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | William Blair | Downgrades | Outperform | Market Perform |

| Dec 2021 | Goldman Sachs | Maintains | Neutral | |

| Dec 2021 | Goldman Sachs | Downgrades | Buy | Neutral |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Acquisition RumorsAnalyst Color M&A News Rumors Analyst Ratings Movers Tech Best of Benzinga