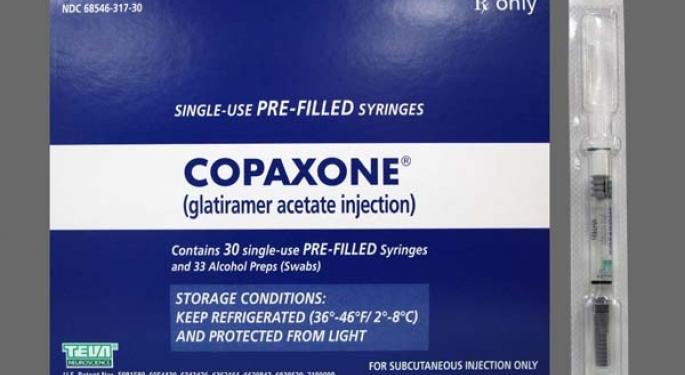

What The Copaxone Court Ruling Means For Teva Pharmaceuticals

“The district court ruled against Teva Pharmaceutical Industries Ltd (ADR) (NYSE: TEVA) in the Copaxone 40mg patent case, invalidating each of the four patents in the case,” Deutsche Bank’s Gregg Gilbert said in a note, while maintaining a Buy rating on the company, with a price target of $48.

Negative Ruling

Although there are two more patents being litigated separately, and Teva Pharma is planning an immediate appeal, the analyst believes the decision “opens the door to potential at-risk generic launches” in 2017.

Gilbert pointed out that since there had been investor concerns regarding management credibility and three of the company’s patents not faring well in the inter parties review (IPR) process, investors had been expecting a negative ruling, with generic competition kicking off either in 2017 or 2018.

Estimates

“To factor in the potential risk of generic competition to Copaxone 40mg, we model generic erosion starting in 2H17, with ~40 percent sales erosion in 2018 (first full year), followed by 15 percent annual erosion,” the analyst stated.

While these estimates could prove conservative, since Teva Pharma has been able to successfully manage the generic erosion of Copaxone 20mg.

At last check, shares of Teva were down 4.08 percent at $33.11.

Image Credit: By Mariusz Ch. - Own work, CC BY-SA 3.0, via Wikimedia Commons

Latest Ratings for TEVA

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Barclays | Maintains | Equal-Weight | |

| Jan 2022 | Argus Research | Downgrades | Buy | Hold |

| Oct 2021 | Raymond James | Downgrades | Outperform | Market Perform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Biotech Long Ideas News Health Care Reiteration Legal Analyst Ratings Best of Benzinga