Rail Stock Woes: Margin Management And The Law Of Diminishing Returns

For railroad companies like CSX Corporation (NASDAQ: CSX), improvements in operating ratio are always good news for shareholders. But according to a new report from Loop Capital analyst Rick Paterson, focusing on operating ratio will only take a railroad stock so far.

Rails

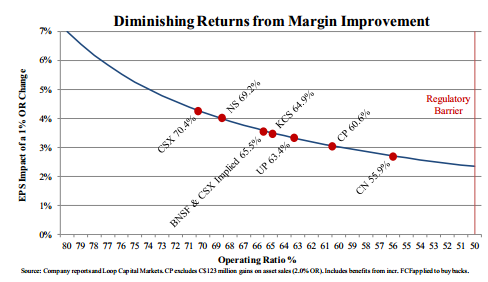

Paterson pointed out that as operating ratios continue to shrink, railroad investors experience diminishing returns in terms of earnings.

“We’re experienced (old) enough to remember the days of 80 percent + operating ratios for most of these companies, and back then a 1 percent improvement was a big deal, driving about a 7 percent boost in EPS by itself,” Paterson explained.

Today, with CSX’s operating ratio already sitting around 70 percent, Paterson estimates that a 1 percent improvement would only equate to a roughly 4 percent EPS boost.

A company’s operating ratio is a measure of efficiency that is calculated by adding a company’s production expenses to its administrative expenses and then dividing by its net sales. Paterson argues that railroad stocks can only cut costs so much to improve operating ratio before the focus must shift to growth.

Operating Ratios

The current operating ratios of CSX, Norfolk Southern Corp. (NYSE: NSC), Kansas City Southern (NYSE: KSU), Union Pacific Corporation (NYSE: UP), Canadian National Railway (USA) (NYSE: CNI) and Canadian Pacific Railway Limited (USA) (NYSE: CP), as well as the diminishing returns associated with potential improvements, are included in the chart below. The chart also includes the implied 65.5 percent ratio of a combined CSX/BNSF entity.

Bottom Line

“The bottom line is that we think continuing to push primarily on the operating ratio is yesterday’s game, and tomorrow’s winners will be those railroads that finally unlock the ability to reasonably consistently grow above GDP,” Paterson concluded.

Loop maintains Buy ratings on Canadian Pacific and Kansas City Southern. The firm has Hold ratings on CSX, Norfolk Southern, Canadian National and Union Pacific.

Related Link:

Which Rail Stock Should You Board? Breaking Down Wells Fargo's Initiations In The Sector

Should CSX Shareholders Reimburse New CEO Hunter Harrison For Lost Pay From Canadian Pacific?

Latest Ratings for CNX

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Dec 2021 | JP Morgan | Downgrades | Overweight | Neutral |

| Oct 2021 | Raymond James | Downgrades | Outperform | Underperform |

| Aug 2021 | Raymond James | Maintains | Outperform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Long Ideas News Commodities Travel Markets Analyst Ratings Movers Best of Benzinga