Did Globalstar Deserve To Move Higher On Straight Path Takeover News?

AT&T Inc. (NYSE: T) announced Monday that it had agreed to acquire Straight Path Communications Inc (NYSE: STRP) in a deal valued at $1.6 billion, including liabilities.

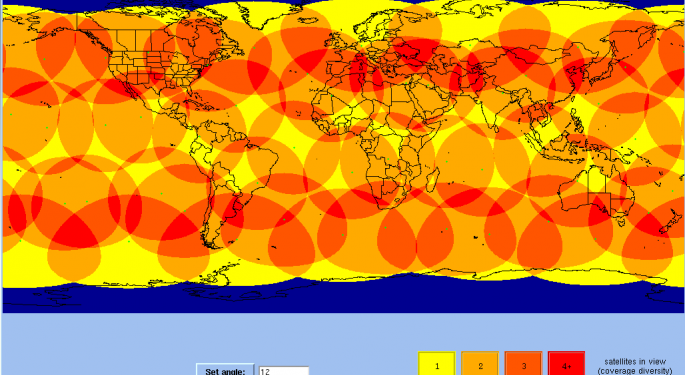

The Straight Path acquisition highlights “the scarcity value of spectrum,” and Globalstar, Inc. (NYSE: GSAT) may soon be in a position to monetize its global spectrum, Chardan Capital Markets’ James McIlree said in a report. He reiterates a Buy rating for Globalstar, with a price target of $2.50.

Inferences From The Acquisition

Straight Path controls 222 billion MHz-POPs [megahertz per population] in the 28GHz/39HGz segment of the spectrum. This spectrum has been designated for 5G small cell use. The acquisition price of $1.6 billion underlines the high value for spectrum, McIlree commented.

“Globalstar's 2.4GHz spectrum is a fair distance from Straight Path's, with significantly different propagation characteristics so a direct price per MHz-POP comparison is not relevant. However we do believe the Straight Path purchase highlights the scarcity value of spectrum,” the analyst wrote.

Globalstar is in the process of seeking ways to monetize its US spectrum position. McIlree believes the company would be in a position to commence its efforts to monetize its global spectrum as well in the coming quarters.

Related Links:

Straight Path Communications Buyout Blindsides Short Sellers

Cliffs Natural Shares Are Hot Hot Hot For Shorts, And So Are These Other 5

________

Image Credit: Coverage of Globalstar, By GrandDixence [Public domain], via Wikimedia Commons

Latest Ratings for GSAT

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jun 2021 | B. Riley Securities | Initiates Coverage On | Buy | |

| Jan 2021 | Morgan Stanley | Downgrades | Equal-Weight | Underweight |

| Jun 2020 | Morgan Stanley | Maintains | Equal-Weight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Long Ideas M&A News Reiteration Analyst Ratings Movers Tech Best of Benzinga