Snap Inc Suffering From Sour Sentiment Heading Into First Public Earnings Report

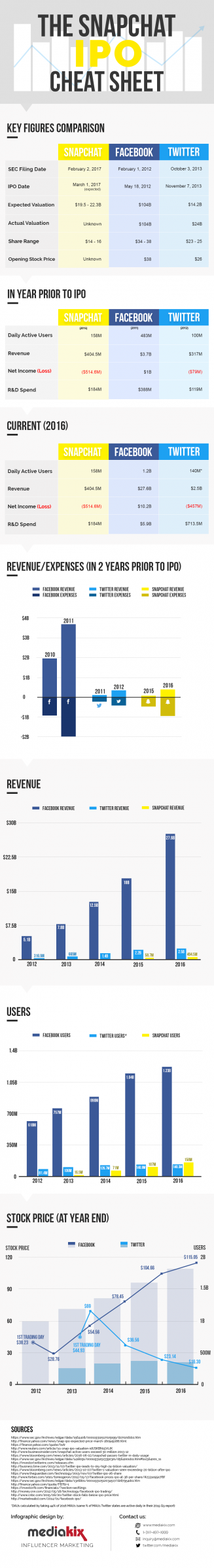

Snap Inc (NYSE: SNAP) has failed to garner much momentum following it highly anticipated IPO in March. As investors prepare for the company’s first earnings report, all eyes will be on the Daily Active Growth figures.

Snap has been suffering from sour investor sentiment, as Facebook Inc (NASDAQ: FB)'s Instagram really stole the company’s thunder with its copycat features. Deutsche Bank believes there could be room for improvement.

“We see ample opportunity for Snap to continue to grow and broaden its user base, and we expect 1Q results to provide evidence to this effect,” analyst Lloyd Walmsley said.

See Also: A Snapshot Of Snap Inc's First Earnings Report

Deutsche Bank is looking for 166.5 million average Daily Active Users, up 7.5 million quarter-over-quarter. DAUs has been deemed the most important metric when looking at Snap and other social media companies in the near term.

Analysts are looking for $130 million in revenue, which is down 21 percent quarter-over-quarter, mostly due seasonality issues including a lack of political ad revenue the company saw in Q4 and lower NFL revenue.

“We hope to get color around the DAU growth outlook, progress on the Android UX, engagement trends around core users/ new users/ among older demographics, and hope to hear more about how DAUs use different parts of the app,” Walmsley said.

Deutsche Bank maintains a Buy rating and $30 price target on Snap, which closed Monday at $22.46.

Image used with permission from Mediakix

Latest Ratings for SNAP

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Deutsche Bank | Initiates Coverage On | Buy | |

| Mar 2022 | Benchmark | Initiates Coverage On | Buy | |

| Feb 2022 | Credit Suisse | Maintains | Outperform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Deutsche Bank Instagram Instagram StoriesAnalyst Color Previews Analyst Ratings Tech Trading Ideas Best of Benzinga