Goldman Expects 16% Sales Growth For FAAMG Stocks; Can It Keep S&P Bull Market Running?

Goldman Sachs analyst David Kostin sees FAAMG stocks — Facebook Inc (NASDAQ: FB), Apple Inc. (NASDAQ: AAPL), Amazon.com, Inc. (NASDAQ: AMZN), Microsoft Corporation (NASDAQ: MSFT) and Alphabet Inc (NASDAQ: GOOG) (NASDAQ: GOOGL) — continuing to have a huge impact on the S&P 500.

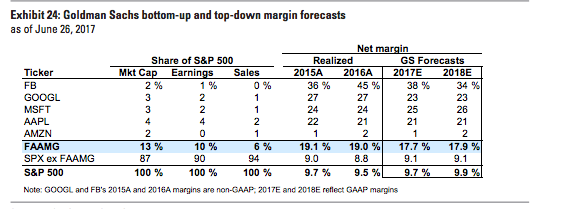

Specifically, Kostin expects the FAAMG group to see 16-percent sales growth over the next two years, led by Amazon, which he expects will boast a 22-percent sales increase.

Don’t Be Fooled By Misleading Margins

While it looks like these mega-cap technology companies will have declining margins over the next two years, Kostin highlighted that this is not the case.

“Historical margins for Google and Facebook were calculated excluding the impact of stock-based compensation, but both companies recently announced they will report only GAAP results moving forward,” he said. “While the companies’ actual profitability is unaffected, the change will significantly impact the calculation of FAAMG and S&P 500 margins.”

FAAMG Driving The S&P 500

According to Kostin’s calculations, FAAMG stocks are going to produce only $0.70 in incremental S&P 500 EPS. However, “Despite a limited impact on S&P 500 fundamentals, FAAMG continues to drive S&P 500 price action. FAAMG has rallied by 25%YTD, contributing 28% of S&P 500’s total YTD return of 10%,” Kostin concluded.

Whether there is or is not a tech bubble over the next few years, Kostin believes FAAMG stocks will continue to be major players in the market.

Related Links:

Why This Is Not The Tech Bubble All Over Again

Goldman Compares 'FAAMG' Stocks To High-Flyers Of The Dot-Com Bubble

Latest Ratings for FB

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Deutsche Bank | Initiates Coverage On | Buy | |

| Mar 2022 | Piper Sandler | Maintains | Neutral | |

| Mar 2022 | Morgan Stanley | Maintains | Overweight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: FAAMGAnalyst Color Top Stories Markets Analyst Ratings Tech Trading Ideas Best of Benzinga