Surprise Positive News Continues To Lift Chicago Bridge & Iron Shares

Chicago Bridge & Iron Company N.V. (NYSE: CBI) received a nice gift on Tuesday after the Delaware Court ruled in its favor in a dispute with Westinghouse, sending the stock soaring 45 percent in the interim.

”CBI had appealed a lower court's decision, which was to send the case to arbitration, to the Delaware Supreme Court. CBI was hoping the higher court would rule in its favor and force the lower court to hear the matter as breach of contract law. This ruling actually goes much further, ordering the lower court to rule in CBI's favor,” David Scott, MKM Partners executive director, said as he reiterated his Buy rating with a $34 price target.

Deciphering The Significance

This ruling has a couple of implications for Chicago Bridge & Iron according to Scott. First, the disputed money, which was over $2 billion according to Westinghouse, is now less than $70 million. Second, the ruling will not be able to be appealed, which will prevent Chicago Bridge & Iron from receiving about $400 million.

“Investors had been contemplating various settlement scenarios that involved payments of several hundred million dollars by CBI, and it is our opinion that this is pretty much the best outcome CBI could have hoped for,” Scott noted. He also highlighted how this removed a major overhang for Chicago Bridge & Iron investors.

What To Watch Out For?

Chicago Bridge & Iron is set to report its Sale of Capital Services on Friday, and Scott sees this as the next catalyst for the stock. Specifically, he noted, “This is expected to yield $755 million of cash that the company will use to reduce debt levels, giving much needed space for the company to stay in compliance with its covenants.”

After this report, investors should focus on the transition to the next CEO and Chicago Bridge & Iron's next earnings release.

Overall, it is clear Scott sees a lot to like going forward for Chicago Bridge & Iron.

At time of publication, Chicago Bridge & Iron was up 8.14 percent at $21.66.

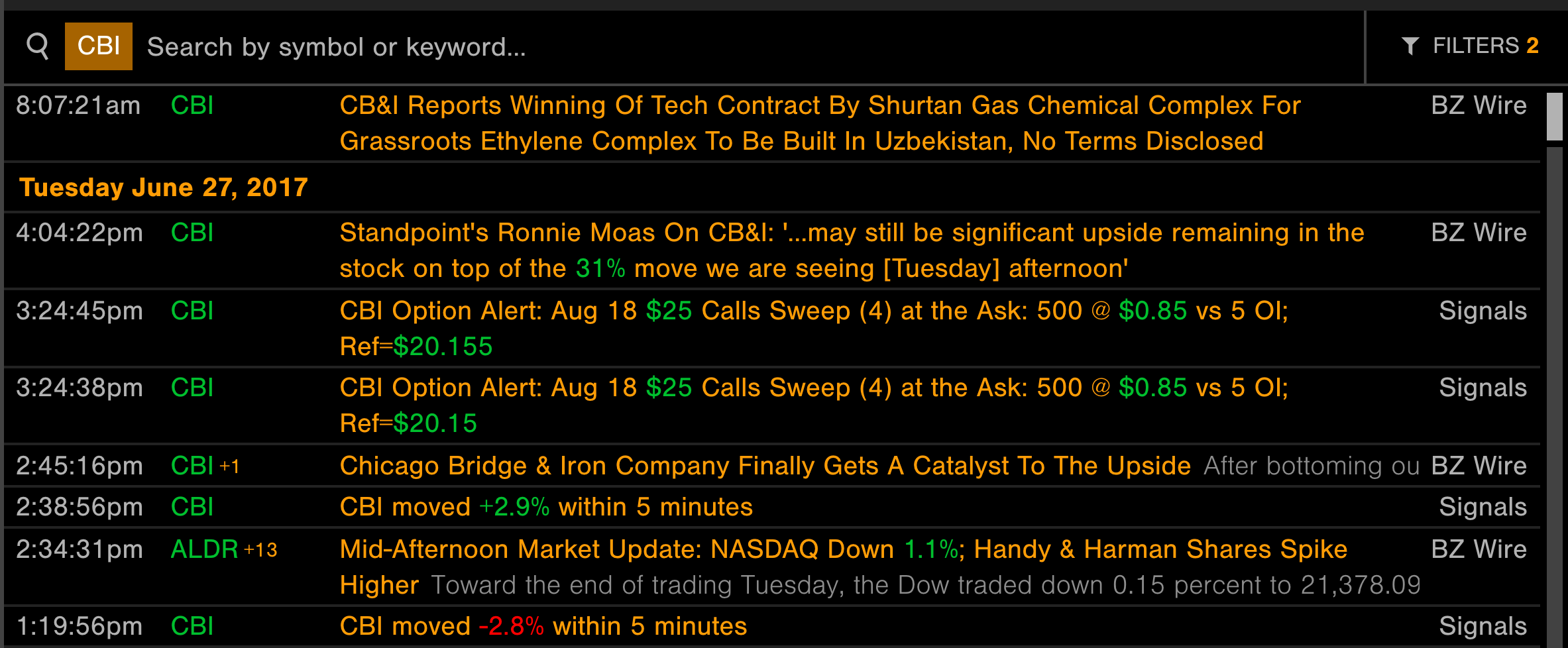

To stay up to date on the latest news on Chicago Bridge & Iron check out the Benzinga Pro News Wire.

Related Links:

Chicago Bridge & Iron Company Finally Gets A Catalyst To The Upside

The True Cost Of Fixing America's Infrastructure

_______

Image Credit: By WhisperToMe - Own work, CC0, via Wikimedia Commons

Latest Ratings for CBI

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Apr 2018 | Citigroup | Maintains | Neutral | Neutral |

| Dec 2017 | DA Davidson | Downgrades | Buy | Neutral |

| Nov 2017 | Credit Suisse | Maintains | Neutral |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Long Ideas News Reiteration Legal Analyst Ratings Movers Trading Ideas Best of Benzinga