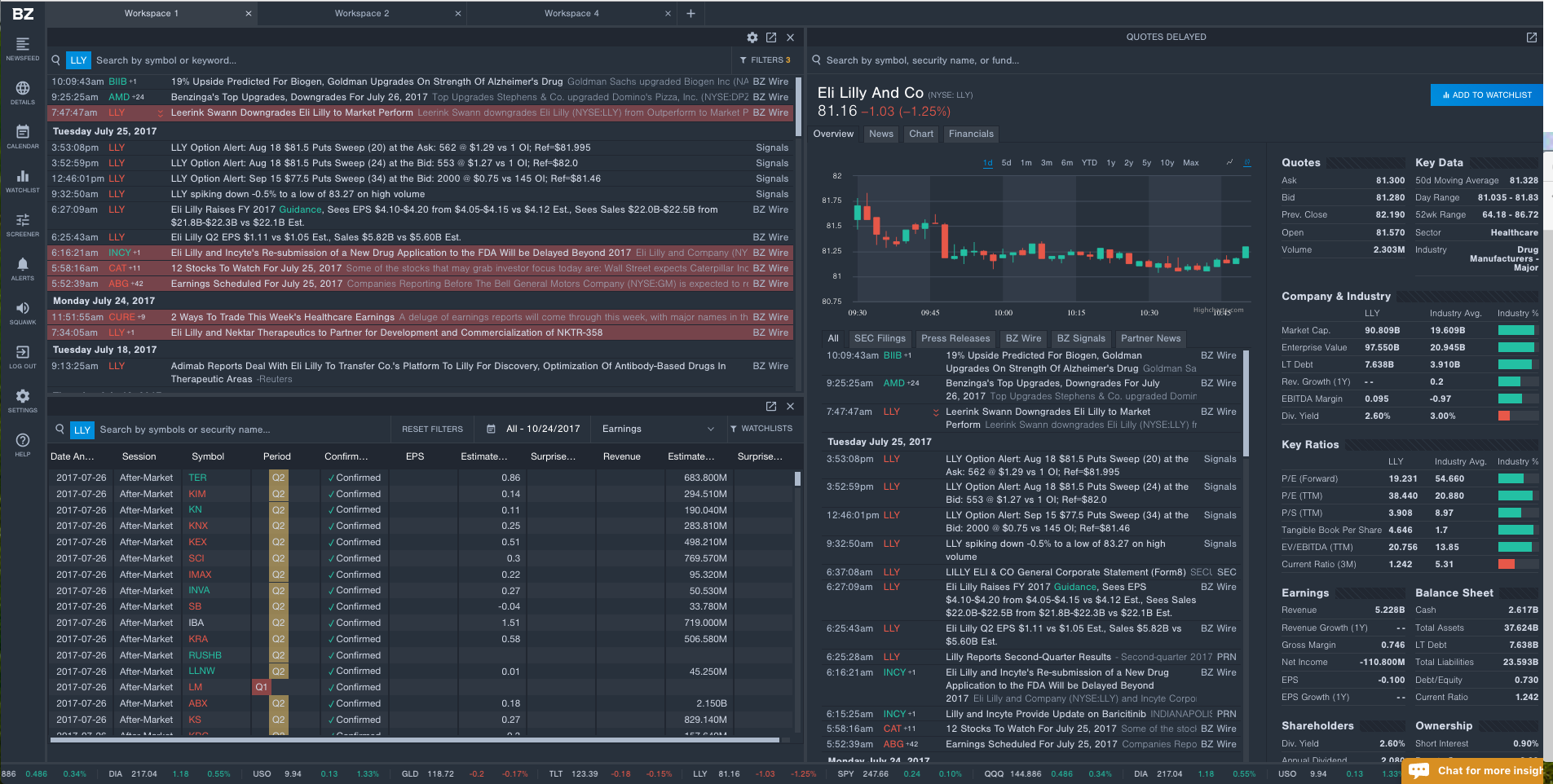

Intense Competition Pressures Eli Lilly, Leerink Downgrades

Despite a strong quarter, analysts see a difficult road ahead for Eli Lilly And Co (NYSE: LLY).

“Even though Eli Lilly's launch execution has been outstanding," Leerink Managing Director Seamus Fernandez said, "the ways for LLY investors to win in our view appear limited when NVO's SUSTAIN 7 reads out this quarter, and predicting the outcome of the Alimta IPR likely is no better than 50/50 (despite LLY winning at trial and on appeal in the usual courts)."

Fernandez downgraded Eli Lilly to Market Perform with a price target between $90 and $93.

Further, following Eli Lilly’s earnings call, UBS analyst Marc Goodman believes the company's earnings beat and guidance raise was simply not good enough. Shares of Eli Lilly fell over 3 percent after Monday’s report.

“In addition to some residual Baricitinib disappointment and some sector rotation out of pharma, investors are pointing to weakness in Animal Health, positive pricing from a few older products (Forteo, Cialis) driving some of the upside, fewer catalysts in 2H17 as reasons for the negative stock performance,” Goodman said as he maintained his Neutral rating and $85 price target.

See Also: 19% Upside Predicted For Biogen, Goldman Upgrades On Strength Of Alzheimer's Drug

4 Reasons Behind The Bearish Calls

- Animal Health remains a notably weak franchise, with declining metrics.

- Despite the excitement around JAK inhibitors, “we believe the regulatory update for Olumiant removes upside optionality in rheumatoid arthritis (RA) and possibly other indications given concerns over thrombosis (DVT/PE) risk,” Fernandez wrote.

- SUSTAIN 7 approaches a no-win situation for Trulicity according to Fernandez. "While we expect Trulicity growth to continue, we believe the range of outcomes weigh against Lilly & Co. given semaglutide’s importance to NVO’s diabetes portfolio,” he said.

- Everyone already expects a positive Alimta IPR ruling, which leaves little room for upside for Eli Lilly investors.

Shares of Eli Lilly were trading at $81.10 in Wednesday’s session.

To read the latest financial news, visit the Benzinga Pro news wire.

Latest Ratings for LLY

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Morgan Stanley | Maintains | Overweight | |

| Feb 2022 | Mizuho | Maintains | Buy | |

| Jan 2022 | Morgan Stanley | Maintains | Overweight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Leerink Marc Goodman Seamus Fernandez UBSAnalyst Color Downgrades Analyst Ratings Best of Benzinga