Post-Earnings, What To Do With AMD Stock

Advanced Micro Devices, Inc. (NASDAQ: AMD) shares were at the receiving end of post-earnings backlash, as they pulled back by 13.47 percent Wednesday on fairly robust volume (roughly three times the average).

The pullback took the stock to $12.33, the lowest since Sept. 14. Notwithstanding the negative stock reaction, sell-side was fairly upbeat on the prospects and blamed the predicament on soft gross margin guidance and muted guidance on cryptocurrency-related revenues.

Meanwhile, Canaccord Genuity recommended riding the long-term wave on AMD, ignoring the frustrating chop. The firm reiterated its Buy rating and $20 price target for the shares of the company.

In pre-market trading, the stock was up about 1 percent at $12.45.

Analyst Matthew Ramsay called the third quarter results strong and the fourth-quarter revenue and gross margin guidance, also as strong. That said, the analyst said confusion concerning the guidance stemmed from high-margin IP revenue present in the third quarter and not in the fourth quarter.

See also: AMD, Microchip Tech Among Q3 Semiconductor Favorites At Jefferies

Meanwhile, the analyst sees the fourth-quarter margin guidance as demonstrating solid margin expansion of 320 basis points year over year. The analyst expects the trend to continue.

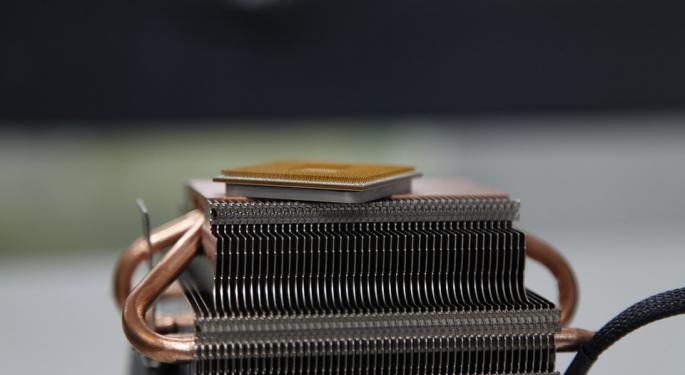

The strong fourth quarter guidance, according to Canaccord Genuity, stemmed from ramping Ryzen desktop and the introduction of new laptop APUs, the recent introduction of EPYC CPUs, near-term blockchain demand for GPUs and the continued ramp of Vega GPUs.

The firm believes these should help overcome a sequential drop in gaming console sales.

"While investors seem focused on the subtleties in gross margin and size of the crypto-currency contribution, we believe the stock pullback creates a buying opportunity for a growth and margin-expansion narrative still very much intact," the firm said.

The firm continues to see a host of positive catalysts remain into 2018 and beyond, as Ryzen and EYPC CPUs ramp and Vega GPUs launch into PC and datacenter markets. That said, the firm acknowledged the risk presented by the 7nm roadmap and competition.

However, the firm said AMD's new products across the PC, GPU and server segments to help the company gain market share gradually and yield materially higher gross margins, relative to current levels.

Latest Ratings for AMD

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Bernstein | Upgrades | Market Perform | Outperform |

| Feb 2022 | Daiwa Capital | Upgrades | Outperform | Buy |

| Feb 2022 | Mizuho | Maintains | Buy |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Analyst Color Earnings Long Ideas News Guidance Reiteration Analyst Ratings Tech Best of Benzinga