Here's Why Roku's Volatility Is OK With This Equity Strategist

Shares of Roku Inc (NASDAQ: ROKU) bottomed at $15.75 shortly after its initial public offering but have since soared above the $50-per-share mark. The stock could be considered as one of the hottest tech names of 2017 — but also one of the most volatile.

The Expert

Matt Maley, an equity strategist with Miller Tabak.

The Strategy

Long-term investors shouldn't be concerned with the near-term volatility in Roku's stock, Maley said.

The Thesis

Roku's history as a public company is short, which makes it difficult to look at the stock's chart to identify any trends, Maley said during a recent CNBC "Trading Nation" segment. While the chart does show a one-day correction of 12 percent earlier this month, it's not an unheard-of move, he said. What is important to note is that after the sell-off, the stock bounced back to trade higher and push its way to $50 per share.

"The one thing we need to know is companies like this have such good upside potential in terms of their business," he said. "10 percent, 12 percent, 20 percent corrections are going to happen all the time. You look at Microsoft Corporation (NASDAQ: MSFT), Amazon.com, Inc. (NASDAQ: AMZN), any of these companies, the first two years of their existence they saw considerable pullbacks."

Price Action

Shares of Roku hit a new all-time high of $50.90 Tuesday morning before pulling back and trading at $48.98, up 5 percent on the day.

Expert: Roku's Post-Q3 Run Could Be Masking Balance Sheet Concerns

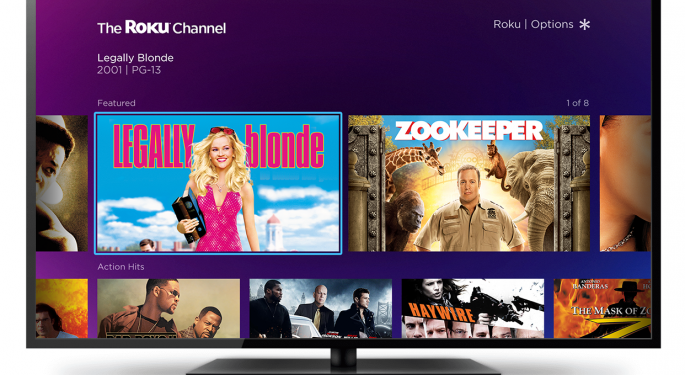

Photo courtesy of Roku.

Latest Ratings for ROKU

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Morgan Stanley | Maintains | Underweight | |

| Feb 2022 | Benchmark | Maintains | Buy | |

| Feb 2022 | Guggenheim | Maintains | Buy |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: CNBC Matt Maley Miller Tabak streaming video Trading NationAnalyst Color Analyst Ratings Media Best of Benzinga