Why Wedbush Says Shopify's Q2 Results Were A 'Blowout'

Shopify (NYSE: SHOP) posted a "blowout" second quarter Wednesday, with revenue that came in nearly 40% above expectations, according to Wedbush Securities.

The Shopify Analyst: Ygal Arounian maintained a Neutral rating on Shopify and raised price target from $998 to $1,053.

The Shopify Takeaways: Shopify decelerated in June and July compared to its peaks in May, but the performance “continues to support our view that e-commerce will ultimately settle at a lower than peak-Covid, but higher than pre-Covid growth over the course of 2020,” Arounian said in a Wednesday note. (See his track record here.)

The analyst named the following as positives from Shopify's second quarter:

- Excellent new store creation that showed a 71% sequential increase.

- Shopify's expectation that the merchants will convert to paying subscribers.

- Shopify is likely to benefit from underpenetrated categories like tobacco.

- Shopify Plus had a record quarter and has an opportunity to add large enterprise clients.

Arounian said he sees upside potential in Shopify’s retail OS.

“Shopify’s model of integrated OS is clearly a winning strategy, and can drive more share gain in an accelerating ecommerce environment where businesses aim to move online quickly.”

SHOP Price Action: Shopify shares were down 0.86% at $1,044.50 at last check Thursday.

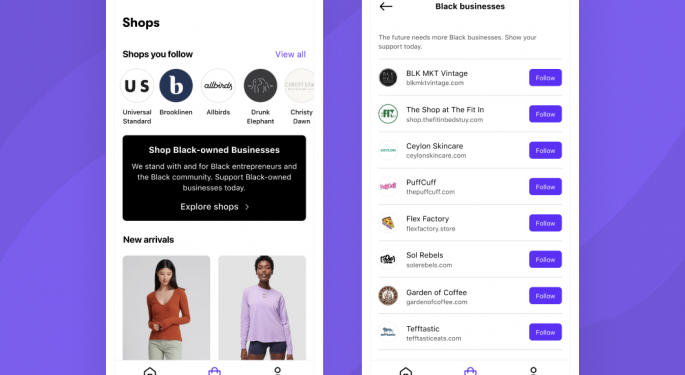

Photo courtesy of Shopify.

Latest Ratings for SHOP

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Morgan Stanley | Maintains | Equal-Weight | |

| Feb 2022 | Credit Suisse | Maintains | Neutral | |

| Feb 2022 | Mizuho | Maintains | Neutral |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: e-commerce WedbushAnalyst Color Earnings News Price Target Reiteration Analyst Ratings