3 Catalysts That Could Drive Stock Prices Higher In 2021

The SPDR S&P 500 ETF Trust (NYSE: SPY) is on track to finish 2020 up about 15.5% on the year. But with the global pandemic still raging and stock valuations at historically high levels, investors are understandably concerned about whether the market rally will continue in 2021.

Bullish Catalysts Ahead: On Tuesday, deVere Group founder and CEO Nigel Green said there are at least three bullish catalysts ahead that could push the market to new highs in 2021.

Related Link: History Suggests ARK Innovation Investors Should Be Careful, Ritholtz Portfolio Manager Says

First, the rollout of coronavirus vaccines will help boost investor and consumer sentiment and potentially even unleash pent-up demand.

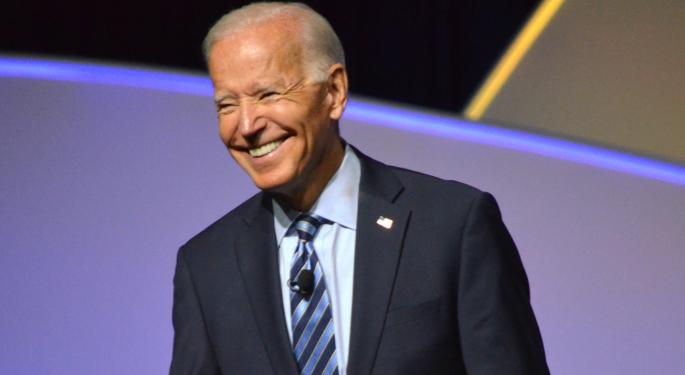

Second, Democrat Joe Biden taking office in January will help stabilize global geopolitical tensions and create a more predictable and certain environment, which is bullish for trade and foreign relations.

Finally, Green said additional fiscal stimulus packages from governments around the world will help keep a floor under stock prices, even if the recovery takes longer than expected.

Green said it’s unlikely the post-pandemic economy will be identical to the pre-pandemic economy.

“It is doubtful the world will go back exactly to how it was pre-COVID — there are many aspects of the ‘new normal’ which people like and support, just a home working,” Green said.

“As such, investors need to look for the lower entry points of quality companies to top-up their portfolios and, critically, they need to bear in mind how the world has changed.”

Benzinga’s Take: A new calendar year is a great time for investors to rebalance and reassess their portfolios and make sure their largest investments are still well-positioned in the evolving economy.

One of the biggest weapons investors have at their disposal to ensure that they will not miss out on upside in 2021 is diversification across different asset classes, market sectors, geographical regions and currencies.

President-elect Joe Biden. Benzinga file photo by Dustin Blitchok.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: deVere Group Nigel GreenAnalyst Color Broad U.S. Equity ETFs Analyst Ratings Trading Ideas ETFs Best of Benzinga