Amazon Analyst Reacts To MGM Studios Buyout Reports

Amazon.com, Inc. (NASDAQ: AMZN) shares traded slightly higher on Tuesday morning after sources reported on Monday the tech giant is nearing a deal to acquire MGM Studios.

What Happened? On Monday afternoon, sources familiar with the matter reported Amazon is nearing a deal to buy MGM Studios for between $8.5 billion and $9 billion. The deal would mark Amazon’s largest acquisition since its $13.7 billion buyout of Whole Foods in 2017.

Related Link: ViacomCBS Jumps After Double Upgrade, Analyst Raises Price Target By 39%

Why It’s Important: On Tuesday, Bank of America analyst Justin Post said MGM Studio offers Amazon an excellent opportunity to boost its Prime streaming service catalog.

“While the reported $9bn price tag would be close to 30% more than MGM traded in private markets (pre-acquisition speculation), the risk of not being a top-5 streaming platform in a consolidating sector may be worth the roughly $3bn (or $6/share) premium for Amazon, in our view,” Post said.

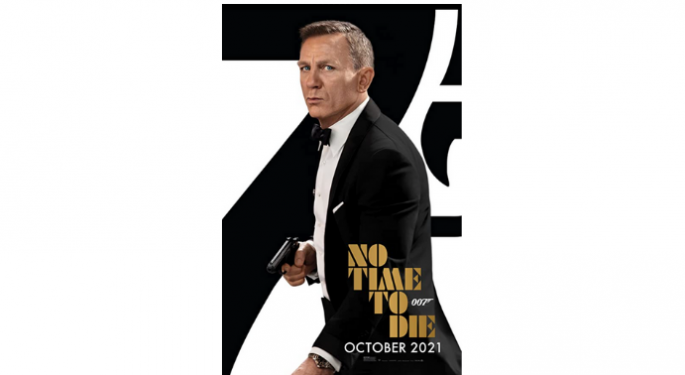

The MGM Studio movie catalog includes popular franchises such as “James Bond,” “Rocky,” and “Pink Panther.” Post said Amazon could also potentially be the exclusive destination for MGM TV shows such as “Shark Tank,” “The Real Housewives” and “The Voice.”

MGM typically lanches eight to 10 theatrical movie releases per year and generates around 650 TV episodes. Its content catalog includes more than 4,000 movies and 17,000 TV episodes.

The company reported $1.5 billion in revenue in 2020, down 3% year-over-year.

While the price tag for the deal is steep relative to MGM Studios private market share price, Post said the addition of all the MGM content could justify an Amazon Prime subscription hike at some point in the near future.

Benzinga’s Take: Streaming content is king in 2021, and Amazon needs to be aggressive with Prime Video to avoid falling further behind market leaders Netflix Inc (NASDAQ: NFLX) and Walt Disney Co (NYSE: DIS). For now, investors should watch for news that a buyout bid has been accepted by MGM as well as any wildcard competing bids from other media or tech companies.

Related Link: Learn about what's happening in the markets on Benzinga's YouTube channel.

(photo: MGM, IMdB)

Latest Ratings for AMZN

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Deutsche Bank | Initiates Coverage On | Buy | |

| Feb 2022 | Tigress Financial | Maintains | Buy | |

| Feb 2022 | Credit Suisse | Maintains | Outperform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Bank of America films Justin Post moviesAnalyst Color M&A Analyst Ratings Media Best of Benzinga